Obtaining a license for many pedestrians in Russia is no less significant event than buying a personal car. However, before you get behind the wheel, you need to worry about all aspects of driving a vehicle, including insurance.

Novice car owners often do not know how to choose an insurance company and what documents are needed to issue an MTPL policy, which often leads to confusion and errors.

Starting from 01.07.2003, all car owners in Russia are obliged to insure their vehicle under the OSAGO program. It was introduced in order to reduce the irresponsibility on the roads that was rampant at that time, which came to the new century from the anarchist 90s.

Starting from 01.07.2003, all car owners in Russia are obliged to insure their vehicle under the OSAGO program. It was introduced in order to reduce the irresponsibility on the roads that was rampant at that time, which came to the new century from the anarchist 90s.

Compulsory motor third party liability insurance is designed to compensate for damage to third parties in those accidents where the owner of this policy was the culprit. Simply put, if you become the culprit of the accident, the insurance company pays money instead of you. At the same time, for 2016, the maximum OSAGO coverage is 400 thousand rubles.

The main factors that determine the cost of the policy:

The main factors that determine the cost of the policy:

- natural or legal person;

- region of registration of the owner;

- vehicle type;

- the period of ownership of the insured vehicle;

- engine power of the insured vehicle;

- age and experience of the driver;

- once again the contract is concluded.

In the process of obtaining insurance, you can get a discount if during the last contract, the car owner did not become the culprit of an accident. The discount is accumulated for accident-free driving over several contracts, and then the amount of insurance becomes tangible.

So, for example, if you have traveled for 10 years without getting into an accident through your own fault, then you can well count on a 50% discount on your insurance policy in the future.

Given the proliferation of expensive cars on the roads of the country, very often the amount of 400 thousand rubles is simply not enough to compensate for all the damage. So, for example, in February 2016 in Chelyabinsk there was “the most expensive accident of the year”, when Lada 2114, having taken off at a red light, rammed at the Rolls-Royce intersection, worth 20 million rubles.

Given the proliferation of expensive cars on the roads of the country, very often the amount of 400 thousand rubles is simply not enough to compensate for all the damage. So, for example, in February 2016 in Chelyabinsk there was “the most expensive accident of the year”, when Lada 2114, having taken off at a red light, rammed at the Rolls-Royce intersection, worth 20 million rubles.

The strong "Briton" held back the blow and protected those present in the car, which cannot be said about the driver of the Lada. After recovering from numerous injuries, he, together with the insurance company, had to reimburse the owner of the foreign car in the amount of 1.5 million rubles.

Avoiding such financial losses allows the DSAGO program - voluntary motor third party liability insurance. This is an addition to the compulsory insurance, which allows to increase the coverage up to 30 million rubles.

Its cost is from 1 to 18 thousand rubles / year, which seems like a mere trifle, compared to the cost of repairing expensive foreign cars.

Where to apply for OSAGO

Obtaining an electronic policy

Obtaining an electronic policy Previously, many insurers practiced bonuses in the form of an accumulated discount for continuous cooperation, so it was considered advisable to stay in one insurance company as long as possible. But with the introduction of KBM (bonus-malus coefficient) and the maintenance of a single database in the PCA, this is no longer relevant.

Now many people look not at the price of the insurance policy, but at the well-being of the insurer. Therefore, it is very important to decide which company to submit documents to for issuing an OSAGO policy.

When choosing it, you should pay attention to the following factors:

When choosing it, you should pay attention to the following factors:

- reputation of the company, period of its existence, percentage of payments, etc .;

- what programs exist and what conditions they offer;

- the cost of services and the mechanism of its formation;

- bonuses for prolongation and renewal of the contract.

Since the introduction of compulsory insurance, against this background, many fraudulent companies have appeared that lure car owners with low prices. However, such offices do not make payments. They try in every possible way to prove the guilt of their client, refer to incorrectly completed documents, bureaucratic errors, or even declare themselves bankrupt.

- Alpha insurance.

- VTB insurance.

- ZHASO.

- Ingosstrakh.

Today, there are also intermediary broker firms that perform insurance duties on behalf of the company. However, their services, as a rule, are in little demand by residents of large cities.

Getting insurance for individuals

The duration of OSAGO is from 3 to 12 months, so experienced car owners know by heart what documents are needed to obtain insurance. The category of individuals among the owners of this insurance is the most numerous, because it includes all Russian citizens who have a private car.

To obtain a policy, the following documents are required:

- an application for an insurance contract. It is filled in on a ready-made form, which is issued at the branch of the company;

- diagnostic card. It testifies to the successful completion of the technical inspection, which is an integral part of the policy. The owner of the car can undergo a technical inspection, both at the service station that he has chosen himself, and at the one that the insurer recommends. In some cases, the UK itself determines the list of service stations at which you can undergo an inspection, and for certain types of transport, such procedures are not needed at all. It must be remembered that the diagnostic card has a limited validity period, after which the inspection must be repeated;

- registration certificate (for new cars that have not yet been registered, you can provide a vehicle passport);

- vehicle owner's passport. In cases where the owner of the car and the policyholder are not the same person, you must have the documents of both. The owner of the OSAGO policy can also be a citizen of another country. He must also provide a passport of his state, if there is no Russian one;

- OSAGO policy (if previously issued). Provided if necessary to renew or renew the contract. In this case, the procedure for obtaining insurance is several times faster, because the documents and all data of the driver and the car were submitted during the receipt of the previous policy;

- driver's license. Provided when insurance is issued with a restriction of admitted drivers. If there are several admitted persons, then you will have to provide a certificate of each of them. With an unlimited number of persons, no rights are required.

In some cases, an authorized person is involved in the issuance of an OSAGO policy. Then this person will also need a power of attorney from the owner of the car.

It is very important that all information provided is truthful, complete and up-to-date. Otherwise, the insurance company has reason not to conclude a contract or even terminate it during the performance period.

Registration of OSAGO for legal entities

To obtain MTPL, they need the following documents:

To obtain MTPL, they need the following documents:

- diagnostic card;

- registration certificate or registration certificate;

- power of attorney from the CEO to represent the interests of the company;

- certificate of state. registration;

- organization seal;

- passport.

The data is checked, and if the insurer does not have any questions, then the application is accepted, and after signing the contract, the authorized person receives such documents as:

- mutually signed insurance policy;

- insurance conditions;

- insurance memo;

- Receipt of payment.

Now the insurance has officially entered into force for the entire agreed period. A month before its expiration, you should start thinking about re-applying to the IC, so that by the time the previous insurance expires, a new one has already been issued.

Electronic CTP policy

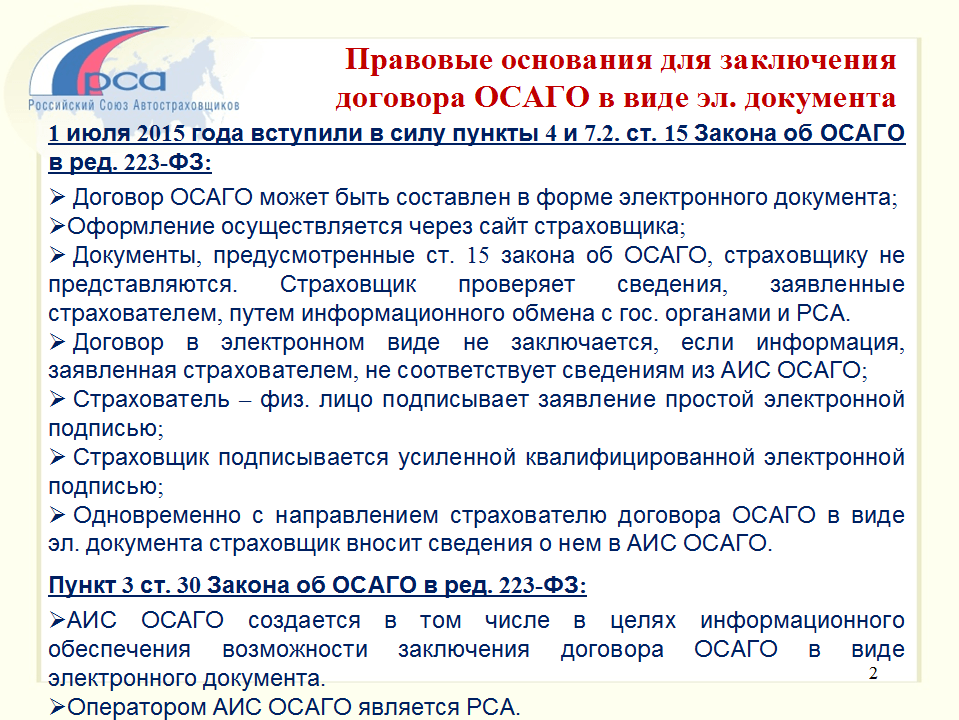

The world of technology does not stand still, so today it is possible to take out motor third party liability insurance without any documents at all and without visiting an insurance company. To do this, you just need to have a computer, laptop or even a tablet, and Internet access.

How to issue an e-OSAGO?

How to issue an e-OSAGO?

- Insurance registration must be done on the official website of the selected company. Today, many companies already have the ability and license for this type of policy.

- To apply, you need to register in your personal account. You will be asked to enter your personal data, the series and number of the passport, driver's license, title, and also enters the data on the insurance history. Here you need to enter your MSC, which is calculated very simply, as well as data about your vehicle.

- The system independently calculates the cost of insurance and if the client wants to purchase it, sends the data for verification to the PCA. This usually takes 30-40 minutes.

- If all the data correspond to those specified in the PCA database, then after the verification procedure, you will be offered to pay for the insurance, and a copy will be sent by e-mail. Here, in your personal account, you can print out the CTP insurance policy and carry it in the car.

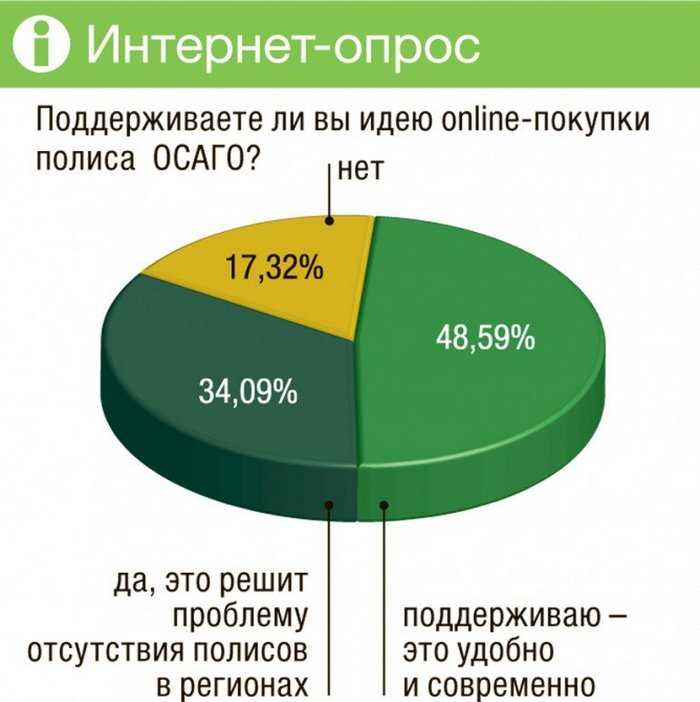

As you can see, issuing OSAGO via the Internet is very convenient, profitable and takes very little time.