Booking tickets for air and rail transport, visiting cinemas, making appointments to a doctor online simplify people's lives and save time. Every year, the process of document flow automation covers new areas of activity. In 2015, innovations hit the insurance industry.

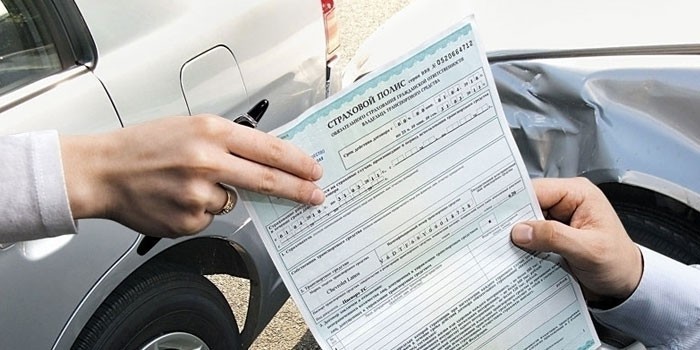

What is an electronic OSAGO policy

The legislation of the country mandatorily provides for the insurance of the car owner against cases that occur as a result of a road traffic accident due to the fault of the insured person when:

- damage to another car;

- causing harm to the health of another person.

The amendments made to the law on insurance activities allow to issue auto insurance online. An electronic MTPL policy gives the same guarantees, has the same legal force as a paper version of an insurance contract on a secure form. Compensation for damages occurs regardless of the method of purchasing insurance in the amount of:

- up to 500,000 rubles - for harm caused to the victim's health;

- up to 400,000 rubles - for damage to the car.

Electronic MTPL can be purchased at a company located in the region of residence of the motorist. This is provided in order to simplify the receipt of compensation, to exclude cases of searching for insurance companies outside the region. The price of auto insurance is the same for both methods of obtaining in all insurance companies. Electronic insurance for OSAGO provides for the calculation of the cost at uniform rates that are valid throughout the country and depend on:

- region of residence of the buyer of insurance;

- type of vehicle;

- age and experience of the driver.

How to issue an electronic OSAGO policy

You can make online OSAGO insurance on the official website of the insurance company. Drivers will find useful recommendations on how to issue MTPL via the Internet. To do this, you need to go through the following steps:

- Register in your personal account, enter the last name, first name, patronymic, gender, passport data on registration, phone number and mail address.

- After gaining access to a sample insurance application, the registration of an electronic MTPL policy begins with entering data in the mandatory lines; to fill in the brand and model of the car, you can use the drop-down menu. The procedure for entering data provides for filling in first the information about the car from the passport of the technical device, the registration certificate and the diagnostic card. Information from the driver's license must be entered at the end of registration. It is useful to check that the entered data matches the data of the previous auto insurance, in order to avoid mistakes.

- After registration there is a pause - the data is automatically verified with the database of the Russian Union of Auto Insurers. At this time, the correctness of filling out the application is checked and whether the indicated documents exist in reality.

- A successful check ends with an offer to pay for insurance. The amount of the insurance premium is calculated according to the tariff. Drivers who did not have an insured event in the previous period are given a discount. You can pay for car insurance in any convenient way online.

- After receiving payment, the insurer generates a document, registers its number and sends an online copy to the car owner at the specified address. Auto insurance must be printed and stored with all documents so that it can be presented to traffic police officers. The traffic police officer checks the authenticity of the insurance against a single database of insurance documents.

Which insurance companies issue an MTPL policy online

Since January 2017, more than sixty insurance companies have been offering their auto insurance services via the Internet. The market leaders are considered the companies Rosgosstrakh, Alfastrakhovanie, VSK, Sogaz, RESO, Ingosstrakh. MTPL insurance online can be carried out on the companies' websites:

- Medexpress;

- NASCO;

- PROMINSTRAKH;

- Alpha insurance;

- RESO;

- Rosgosstrakh;

- Sogaz;

- Ingosstrakh;

- Geopolis;

- YUZHURALZHASO.

Electronic policy OSAGO Rosgosstrakh

The company's website provides visitors with information about the insurance contract, the latest changes in legislative acts, the permissible amount of compensation for losses. Before filling out an application for an electronic OSAGO policy, Rosgosstrakh proposes to calculate the cost of insurance. The site service is convenient for users - it highlights in yellow the fields that have not passed the test or provides a printout of errors.

Electronic policy of OSAGO VSK

The company's website informs visitors about the list of documents required to fill out the application, the method of calculating the discount for insurance. The service provides an opportunity to send messages and questions that arise when filling out an application for an electronic insurance policy VSK. There are two options for filing an application:

- the "Extend" button is intended for regular customers of the company;

- Buy button - for beginners.

Electronic policy OSAGO Sogaz

In the insurance market, Sogaz has a high rating; clients' trust in a reliable company is increasing every year. Sogaz offers to issue an electronic OSAGO policy on its website and provides information about insurance, tariffs and what affects the amount of insurance. Before filling out the application, visitors can calculate the amount of payment on a convenient calculator.

Electronic policy OSAGO RESO

The site offers to get acquainted with information about insurance, tariffs, possible errors when filling out an application, suggests ways to eliminate them. In the insurance section, the address of the support service is indicated for clarification of errors that occur when submitting an application online. Filling out an application for an electronic policy of OSAGO RESO is provided in two versions:

- new client;

- client RESO-Garantia.

Electronic policy of OSAGO Ingosstrakh

The system works well, the exchange of information with the database is fast, there are no difficulties in filling in the fields. The site service offers the visitor the following algorithm of actions - first, calculate the amount of the contribution, and then buy the Ingosstrakh electronic OSAGO policy. To do this, the client must select the type of contract:

- new;

- extend the current one.

Electronic policy of OSAGO Alfa insurance

The site contains instructions on the sequence of filling out an application for an electronic OSAGO Alfa insurance policy. To clarify the data contained in the Russian Union of Auto Insurers, visitors are provided with a mail address. The service invites visitors to place an application using the buy or renew buttons.