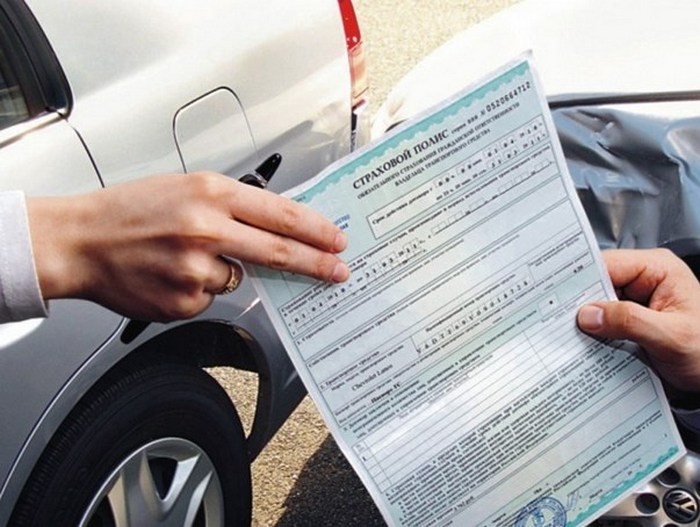

In this case, it is impossible to do without the presence of an OSAGO insurance policy. Its absence will significantly complicate the resolution of the issue of getting into an accident, even if it was not the fault of the motorist. That is why the current Russian legislation provides for the mandatory registration of an insurance policy.

Types of punishments imposed by traffic police officers for lack of OSAGO insurance

It is prohibited to drive a car without an insurance policy. In accordance with the Russian Code of Administrative Offenses, traffic police officers can impose various punishments based on the circumstances of the offense:

- The forgetfulness of a car enthusiast who left an insurance policy anywhere, but not with the documents for the car, will cost him:

- the usual warning;

- a fine of 500 rubles.

- It must be remembered that the CTP insurance policy is valid for 1 year. At the same time, it is possible to take out insurance for a shorter time if the car is not constantly used. If a motorist drives his car during the period not covered by the insurance, then he may receive another 500 rubles in a fine to the ban on driving his car.

- If the car is driven by a person who is not included in the OSAGO insurance policy, then the driver will have to:

- pay a fine of 500 rubles;

- lose registration numbers for a while.

4. To a car enthusiast who:

- forgot to renew an insurance policy which has expired;

- simply did not take out an insurance policy;

will have to answer for the violation:

- obtaining a ban on the subsequent operation of the car;

- payment of a fine of 800 rubles.

Useful tips about insurance policy

The presence of an error in the insurance policy, which was discovered by the traffic police officer, does not allow him to issue a fine to the motorist. You should be aware of this. A traffic police officer in such a situation is obliged to:

- point out the detected error to the car enthusiast;

- ask him to fix the error with the insurance company.

If the motorist does not want to have problems with the traffic police, then he should carefully monitor the timely execution of the insurance policy. It will be especially needed if you get into an accident.