Calculate the cost of OSAGO at the Renaissance insurance company and compare the cost of the policy with the offers of other major insurers with additional discounts.

Today, in the age of modern technologies, you can buy an OSAGO policy via the Internet online, using the websites of insurance companies. The Renaissance company, which is deservedly considered one of the leaders of the domestic market, both in terms of insurance volumes and the quality of customer service, offers a similar service to its customers.

2 clicks and you will find out

A bit of history

The Renaissance company entered the market in the 90s, at the stage of the formation of the Russian insurance market. Since then, it has consistently developed, adding additional offices, expanding the range of services provided, becoming one of the first insurers under the OSAGO program. Over the years, the company has won numerous awards and prizes for the quality of customer service.

Offering a high level of customer service and attractive terms of cooperation, the Renaissance company deservedly has an impressive client base, including not only hundreds of thousands of citizens, but also large companies.

Services provided by IC "Renaissance"

Today the clients of IC "Renaissance" have the opportunity to buy all the main types of insurance that exist on the Russian market. An important place among software products belongs to OSAGO insurance, which accounts for a significant part of the concluded contracts.

The popularity of OSAGO is primarily due to the mandatory status of this type of motor third party liability insurance for any driver driving on public roads. In the absence of insurance for the driver of a fixed size.

This insurance provides car owners with protection against material losses in the event of an accident, when the insured is the culprit of the accident. In this case, the insurer assumes responsibility for compensation for damage to the injured party within the framework of the statutory norms. In the basic version, the maximum amount of compensation is 400 thousand rubles.

Basic principles of OSAGO

Regardless of whether the driver is insured in the Renaissance company or any other, he can apply for insurance payments only if all documents are filled out properly. Otherwise, the insurer has legal grounds to refuse payments to the injured party.

First of all, you should not be led by suggestions to sort it out on the spot. In this case, you can be guaranteed to forget about the possibility of organizing payments from the insurance company. It is mandatory that there are traffic police officers or authorized emergency commissioners at the scene of the incident, which are necessary to complete all documents and protocols. There is a simplified self-registration procedure using the Europrotocol, but at the same time, it is required to observe the utmost care during the procedure. Upon completion of registration, it is advisable to check all documents again.

Buying an OSAGO policy online

For its clients IC "Renaissance" offers the possibility of remote purchase of OSAGO insurance through the Internet. Motorists who previously worked with the insurer can buy a policy in a similar way, without visiting the office directly. For those who first apply to the company for insurance, you will need to issue a policy directly at the office. In both cases, you can use to calculate the cost of the CTP policy for all leading domestic insurance companies, including IC "Renaissance".

The purchase procedure is extremely simplified and allows you to solve the problem within 15-20 minutes after entering the necessary information and making the payment.

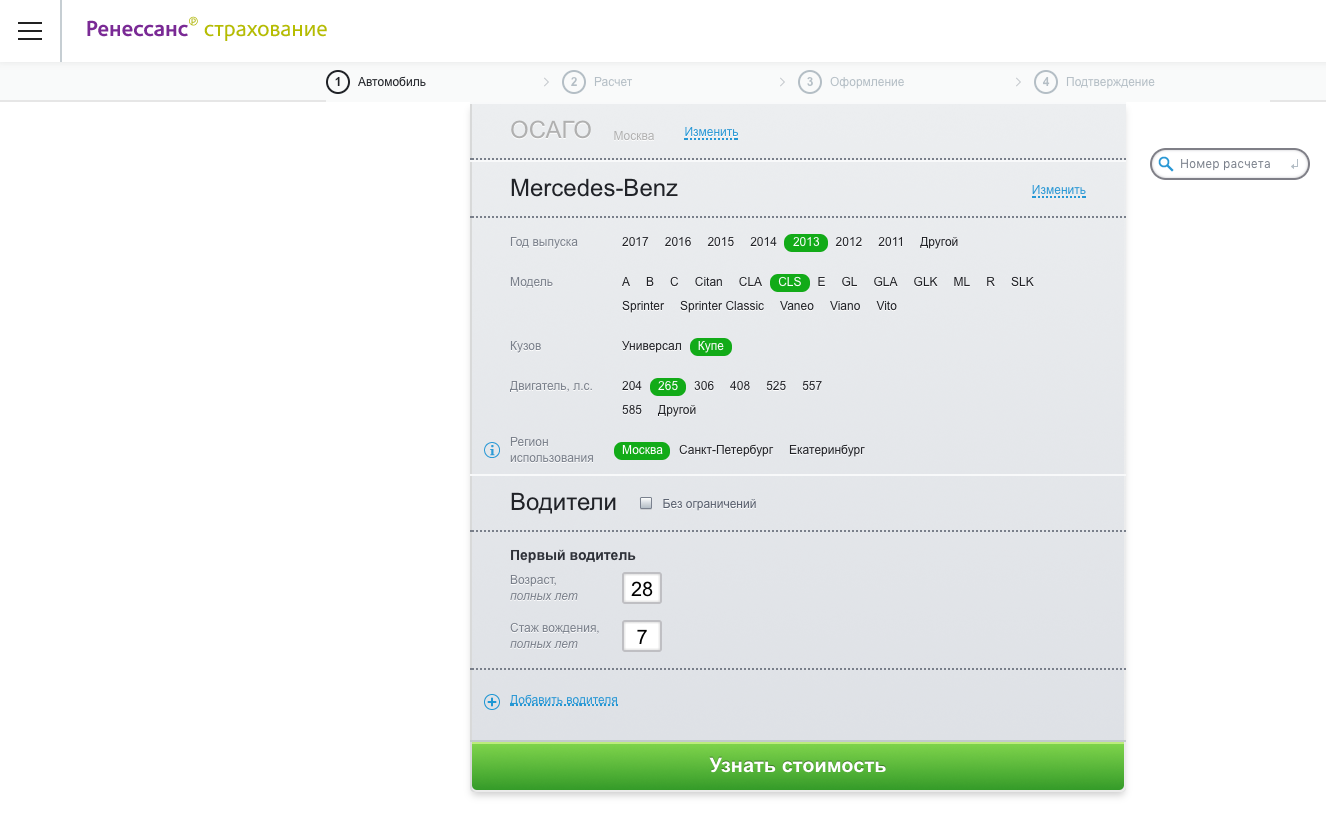

On the Renaissance website, you need to click on the "Buy a policy" link, then fill out a short questionnaire indicating the parameters of the vehicle, the age qualification and driving experience of the persons covered by the insurance, as well as the possibility of choosing extended insurance, for example, increasing the maximum the amount of compensation in the event of an accident.

You can also make a payment online. To do this, it is offered the opportunity to choose between payments from a bank card or electronic wallets, for example, Yandex.Money. After the payment for the purchased insurance is received on the company's accounts, the policy is sent in electronic form to the E-mail. If desired, it can be printed out on a computer for presentation to the police, but you can not do this, leaving it exclusively in electronic format.

For the convenience of customers and a preliminary calculation of the cost of compulsory motor third party liability insurance, a calculator is offered on the Renaissance website that allows you to calculate the cost of insurance online. To do this, enter the following data in the appropriate fields:

- Car model and brand;

- Vehicle age;

- Engine power;

- The number of drivers, their experience and age;

- The presence of insured events;

- The region of residence of the policyholder;

- MBM indicators (bonus-malus).

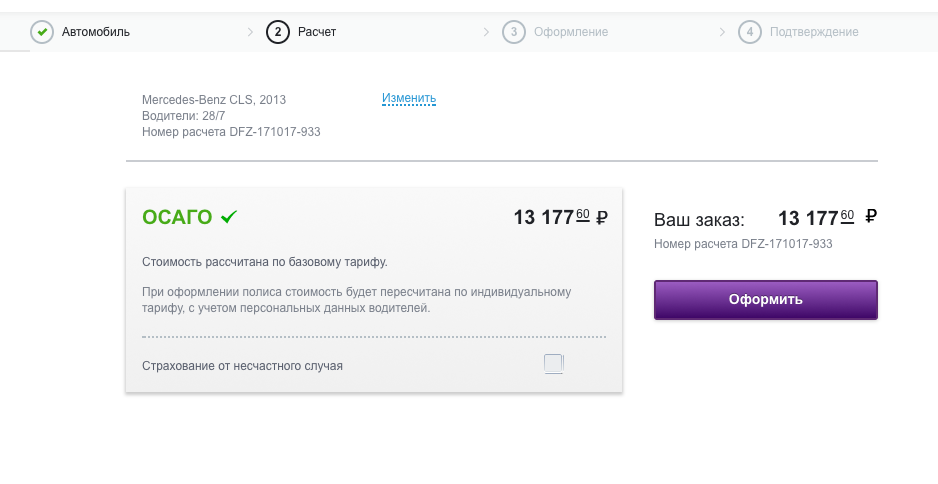

After that, it remains only to click on the "Calculate" button and the amount of insurance will appear on the screen. If you are satisfied with the final price tag, you can buy the policy online here.

Today, there are plenty of companies on the Russian insurance market offering their services in the OSAGO segment. In addition to the Renaissance, others are successfully working on the market. Each of them has its own supporters and opponents, so the final decision on the choice of the insurer remains with the buyer. It should be noted that the Renaissance company is one of the largest in the country, which makes it possible to count on reliability.