Each driver chooses a compulsory MTPL policy on favorable terms. When making a choice, you should pay attention to OSAGO in Renaissance Insurance. The financial organization is ready to offer not only favorable conditions, but also an affordable purchase in real time. Especially for you, we will consider who can take advantage of the offer from SK Renaissance, and how to order the form correctly.

Since 1997, the Renaissance insurance company has been offering all citizens to take advantage of profitable products. At the same time, the insurance company has developed a product line for both individuals and legal citizens. According to the rating agency "RAEX", the financial company was assigned a high level of reliability ruAA-.

As of December 2018, the company:

- occupies 3.1% of the market share

- is included in 600 large companies in Russia

- Ranked # 9 in Voluntary Product Sales and Payouts

- ranks 7th in terms of fees for voluntary auto insurance

The central office of the Renaissance is located in Moscow. The branch network of the financial company is well developed. Renaissance offices are present in every major city throughout the Russian Federation.

Why do you need a policy

The essence of creating a must-have product is to protect every motorist, and more specifically, his financial situation. Within the framework of the program, the payment will be made exclusively to the party injured in the accident. The principle of the policy is very simple. In the event of an accident, payment for repairs to the victim will not come from the personal money of the culprit, but from the funds of Renaissance insurance. It turns out that the guilty party is saving. Every driver understands that the cost of the damage caused can be several times higher than the price for a mandatory protection form.

What protects from

Within the framework of car insurance, only two risks are insured. Under the OSAGO agreement, payment is due if harm is caused to the "iron" and the participants in the movement. The amount of compensation payments is regulated by a single law.

Payout limit:

- for a body element no more than 400,000 rubles for each victim

- for citizens who have been injured, no more than 500,000 rubles for each

Tariffs and conditions

A must-have product is a project that is controlled by the PCA and the Central Bank. It is these institutions that make changes, dictate the order of prices for all participants in the financial market and control the activities of insurers. Consider the rates and conditions.

| Insurance term and period of use | The policy is always issued for a period of 1 year. As for the period of use, it is set by each policyholder at its own discretion. The minimum period for vehicle operation should not be less than 3 months. For transport, which is issued for the purpose of ferrying, a transit agreement is provided for 20 days. You can get a protection form for a transit car only if the corresponding numbers are available. |

| Pay | As a result of an accident, the injured party can receive money in cash or use a form of payment in kind. In the first case, the assessment is made by an independent expert, as a result of which the insured receives money to the current account. In the second case, the client is given a referral to the station, which performs repair work. As far as payment is concerned, all expenses come from the Renaissance funds. |

| Registration | You can conclude OSAGO in any way convenient for you. Purchase options:

It doesn't matter which method of registration is chosen, you will need to prepare a full package of documents. |

| Discounts (KBM) | The indicator that reflects the driving of the traffic participant is necessarily taken into account. Tidy drivers have a discount, which can be up to 50%. Emergency road users receive a multiplier. |

| Termination | The contract form can be terminated, both at the initiative of the policyholder and the insurer. The customer can collect funds if the car is sold, disposed of or the owner has died. Renaissance may terminate and not pay money if it reveals the fact of fraud on the part of the client. |

| Alteration | During the insurance year, each client is obliged to report all changes. For example, the client is obliged to notify about the change of surname, passport data, registration, transport characteristics. |

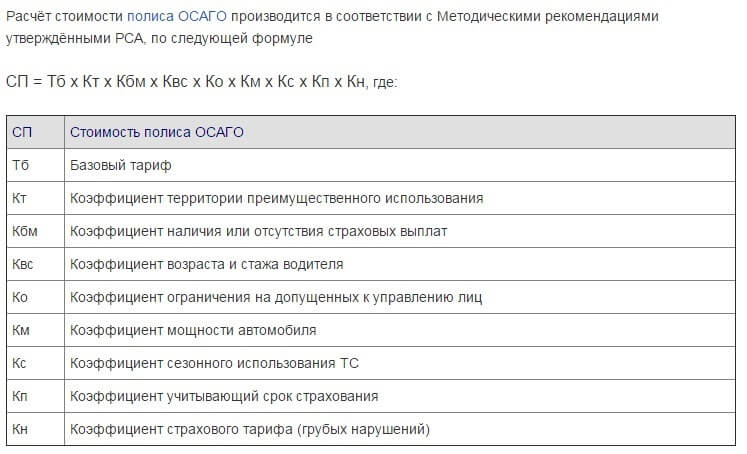

The cost is calculated according to the approved formula.

| Base | Determined from the type of transport vehicle (light, truck, etc.) for which the compulsory insurance form is purchased. |

| Territory | Each city and small town has its own coefficient. The maximum rates are determined for large cities where there are a large number of accidents every day. For sparsely populated cities or villages, a minimum indicator is set. |

| Drivers | Each participant in the movement has its own indicator. Since 2019, 10 ranges have been established by experience and 8 by age. Thus, experienced motorists who are over 59 years old can get the minimum indicator when calculating. Those who have just received the license will need to overpay, almost 2 times. |

| Number of insured persons | You can either enter 5 drivers, or choose a condition that everyone can drive. In the latter case, an upward index of 1.87 is applied. |

| Power | 6 power grades approved. The more horsepower, the higher the ratio. |

| Seasonality | Insurance is available from 14 days to a year. The minimum period for a transit car. Registered vehicles can be issued for at least 3 months. For a minimum period, the Renaissance charges half of the price. |

| KBM | The indicator is taken into account according to the PCA base. |

For convenience, you can form a calculation for the new tariffs using the calculator on our website.

What determines the cost

Price is the main thing that motorists pay attention to. It should be noted that the value of the contract is determined in relation to each motorist, based on his needs and conditions. Its size is influenced by:

- which car needs to be insured

- how old is the driver

- what is the driving experience

- where is the owner of the car registered

- discount for trouble-free driving

- validity period of the form

- horsepower

Who can issue

Any capable citizen over the age of 18 can purchase an OSAGO policy. In this case, both the owner and another person can conclude a policy. A notarized or ordinary power of attorney for insurance is not required. The main thing is to present all the documents requested by the Renaissance. When filling out the protection form, the insured must know that only he can make changes to the policy. Also, the policyholder can also terminate the policy and receive payment in the cases provided for by the rules.

How to buy

Several years ago, Renaissance clients were able to purchase the form online. This design method immediately became in demand.

Online application

Cost calculation

As soon as all the data in the online application is entered, each motorist will be able to request a calculation. It should be noted that before sending a request, it is necessary to check the correctness of the specified information. If mistakes are made, it is worth making corrections. The undoubted advantage of online registration is the fact that you can send requests for calculating the cost an unlimited number of times by changing the conditions. For example, you can calculate insurance for a year, and if you are limited in finances, then send a request for a cost for a shorter period. This will allow you to plan financial expenses and know in advance how much you will need to pay in the future.

PCA data validation

If the e-insurance policy provides for a limited number of persons, then before displaying the amount, Renaissance makes a request to the PCA. The essence of this request is to obtain up-to-date information about the size of the coefficient, which depends on the presence or absence of payments. As soon as the check passes, you will be able to familiarize yourself with the bonuses for each driver or policyholder, if the policy is unlimited. If all discounts are displayed and there are no complaints, then you can complete the purchase procedure. To do this, you need to pay for the form.

Payment and receipt

The form registered in the PCA will remain to be paid. You can only transfer money from a debit or credit card. The payment procedure is no different from buying goods over the Internet.

The client will be able to receive the policy after payment. The contract form will be immediately displayed in your personal account and sent to your e-mail address.

The car insurance form will need to be printed. As part of the law, you can print a document on a regular sheet of paper in black and white.

You do not need to contact the Renaissance office in order to obtain e-OSAGO on a letterhead. If you wish, you can drop the policy on your mobile phone and show the photo to the traffic police.

The documents

The list of mandatory documents is spelled out in 40 of the Federal Law, in article 15 "Procedure for the implementation of compulsory insurance." After studying it, it will become clear that you need to present:

- document to confirm the identity and registration of the policyholder and the insurer

- vehicle registration document

- with limited insurance, a driver's license for each participant in the movement

- technical inspection

Legal entities must additionally provide a completed application form and registration documents for the company. Also, for this category of clients, full details of the organization are requested.

What to look for

When starting the procedure for e-insurance in the Renaissance, you should know that there are points that you should pay attention to. Since insurers hide them, we will consider the nuances in our article.

What you should pay attention to:

- The validity period of e-OSAGO. The policy begins to operate only 3 days after the conclusion. That is why it is necessary to draw up a car insurance in advance.

- Pay. For payment, you will need to contact the office personally. How compensation is received will be discussed below.

- Alteration. If your data changes during the insurance year, you should enter the client's personal account to make changes. This is especially true when changing a driver's license. It is no secret that discounts for accident-free driving are taken into account for them.

Actions in the event of an insured event

The rules for fixing an insured event are enshrined at the legislative level. If the client violates the requirements, then the Renaissance can legally refuse to pay. You can issue an insured event yourself according to the European protocol or by calling the traffic police. In the first case, you can save your personal time. However, registration under the European protocol is available if:

- two vehicles are involved in the accident

- motorists have agreed on who is the injured party

- there are no citizens who have suffered harm to life and health as a result of the accident

- the amount of damage caused does not exceed the approved limit for the region in which the accident occurred.

For example, residents of Moscow can independently record an insured event, the amount of damage for which is not more than 400 thousand rubles. As for small towns and settlements, in this case, citizens can register a loss on their own, provided that the amount of damage is not more than 100 thousand rubles.

When registering a case according to the European protocol, you will need to fill out a form without blots and take a photo of the accident scene. After that, it will remain within 5 working days for the injured party to contact the insurer's office. If an emergency is recorded with the participation of traffic police officers, then you should sign the protocol and contact the office of the financial organization with a full package of documents.

Payouts

To receive payment, each victim must write a statement. The document must indicate how you want to receive the payment.

Available:

- cash

- repair

You can find out the list of stations in the region where you are located on the official Renaissance website. All you need to do is select a region and send a request in the section "Insured event under OSAGO". The required documents must be submitted to the form and the damaged vehicle must be shown.

Online calculator

For the convenience of the car enthusiast, we have placed a simple calculator with which you can find out the cost of car insurance. All you need to do is provide the minimum information and submit a request. You can get information on the cost of e-OSAGO at any time of the day or night for free. As soon as the offer is received, you can send an application for registration both to Renaissance insurance and to another company that, in your opinion, offers insurance at the lowest price.

Advantages

Some motorists are wary of the electronic insurance procedure. In fact, it is worth giving up personal registration, since the remote conclusion of the form has a number of advantages.

- No need to adjust to the office schedule, take time off from work or waste time on a weekend. You decide at what time you visit the website of the financial company and submit an online application.

- No additional services, which are so often talked about in the office of a financial company. This will save you several thousand rubles.

- You decide on what terms and conditions to purchase an electronic vehicle license.

- The agreement provides for a discount for accident-free driving. All data are verified through the PCA portal.

- After registration, all changes in the compulsory insurance form are made through the client's personal account. This saves a lot of time.

disadvantages

Despite all the advantages, the remote product has a number of disadvantages.

Cons of online registration:

- The policyholder is responsible for the correctness and reliability of the information specified in the form.

- You cannot pay for the policy with electronic money or from a bank account.

As for other shortcomings, they simply do not exist.

How to terminate the contract

The policyholder or another person, with a notarized power of attorney, can terminate the e-OSAGO form. It is important to take into account that the refund is provided only in some cases, which are spelled out in 40 FZ. You can get money for the remaining period of time if:

- the machine is sold or scrapped

- the owner died

- the insurer left the market or lost the power of attorney

To get the money back you will need:

- Contact the office personally.

- Submit your passport, account details, policy and a document confirming the termination of ownership. For example, if the vehicle is sold, then a purchase and sale agreement must be presented.

- Write a statement of the approved form, the template of which will be provided by the Renaissance specialist. A copy of the completed application form must be requested, with a mark of acceptance.

Renaissance transfers money from the moment of receiving the application, within 20 working days. Additionally, it is worth noting that the return is calculated not from the date of termination of ownership, but when the policyholder contacted the office. As a result, it is necessary to apply as soon as possible, since in this case time is real money.