Here are collected reviews of travelers about the Renaissance travel insurance from all Russian forums and most Western ones. I update them every six months and these are relevant for March 2017. If travel insurance is new to you, then be sure to read the most important post and most of your questions will disappear. ...

There are many more negative reviews than positive ones, but mostly they are related to the work of the infamous GVA assistance. In 2017, Renaissance Insurance also began working with the assistance of AP Companies. There are still few reviews about this bundle.

What is the price: 2 700 RUB for two

Standard insurance for two adults for 14 days will cost 2,713 rubles. Insurance for a child is more expensive - 2000 rubles. for one.

Renaissance insures children from 0 years old, but does not insure people over 64 years old.

Insurance conditions: difficult to fulfill

I met many reviews in which tourists were outraged that the insurance company refused to compensate for the treatment due to a violation of the insurance conditions. Let me remind you the most common reasons for refusal:

- the tourist drank and an insured event occurred. The insurance company may ask for a blood test to confirm the absence of alcohol in the blood;

- on vacation there was an exacerbation of a chronic disease. It doesn't matter if the tourist knew about him or not;

- the tourist did not call the insurance company when an insured event occurred, refused to follow the instructions or violated them;

- if the tourist has not bought additional insurance and is engaged in outdoor activities or sports. For example, I went surfing and damaged a bundle. For the Renaissance, this is the most common reason for refusal to pay.

In addition to this list, Renaissance Insurance does not compensate for the costs associated with the course of treatment that you started and continued during the insurance period. That is, if you have been taking pills for a long time, and in Thailand you have side effects from the treatment, this case will not be recognized as insured.

The insurance will not return money for dietary supplements and vitamins, even if they were prescribed by a doctor.

Add. insurance "Active rest": it is better to buy

If during the trip you do not plan to lie on the beach all day, you will need additional insurance. The Renaissance has very strict requirements for what is considered an active vacation, therefore, almost any injury can be recognized as a non-insured event, if you have not bought the additional "Active Vacation" option.

According to the rules of Renaissance Insurance, the concept of active recreation includes:

Fun on the water... Visiting water attractions, water parks, diving and other types of water recreation using special devices, scuba diving with an instructor at a depth of no more than 10 m. This also applies to banana rides.

Team games. Volleyball, football, badminton, basketball, paintball, bowling, golf, tennis.

Driving any vehicle other than a car... This includes riding mopeds, motor scooters, motorcycles, ATVs, boats (rowing, motor), rafts and small boats, water scooters, gliding, paragliding, hang gliding.

Even bike rides are considered active recreation. Bicycle falls, judging by the reviews, are a popular reason for contacting insurance. And very few people know that this is not an insured event. Particularly cunning advisers on the forums recommend that victims not say that they were injured while driving a bike. But insurance companies are very suspicious of such cases. Better to buy additional insurance and not worry.

Animal management. Travel on horses and other animals. Elephant trekking tours are also included.

Hiking... Trekking, hiking, traveling in caves without the use of special equipment.

If you are even remotely planning to do any of the above, then you need additional insurance "Active rest". Without it, in case of injury, you will have to be treated at your own expense.

Franchise: 50 $

For Thailand, an unconditional deductible of $ 50 is included in the policy. This means that when you go to the hospital, you pay $ 50, and the insurance will cover the rest.

For example, you slipped and hurt your leg. At the hospital, you got an X-ray, treated your bruise and put on an elastic bandage. You paid $ 70 for all procedures. Of these, the insurance will return you only $ 20 - the difference between the actual costs and the deductible.

Policy issuance: the day before departure

The policy begins to operate the next day after purchase, so you can buy it right before your trip.

In one of the answers, a company representative told how to issue a Renaissance Insurance policy during a trip - ask someone in Russia to issue a policy for you.

The answer of the insurance representative on the Banki.ru website

Contacts: by phone and via the app

When an insured event occurs, you need to call the phone number specified in the policy. In addition to this, Renaissance Insurance has its own SafeTrip application.

With SafeTrip, you can call an operator at the touch of a button. The application stores all information about the policy, monitors the validity of the insurance and reminds you when to issue a new one.

Payment of compensation: subject to all conditions

You can write an application and submit documents for reimbursement of expenses within five days after returning to Russia.

You need to provide to the insurance:

- The original of the policy (for the annual policy - a copy)

- Statement

- Birth certificate (if the child is insured; in this case, the application is completed by the legal representative or the Policyholder)

- Passport of a citizen of the Russian Federation (or a foreign passport, or an officer's identity card, or a sailor's passport)

- Copies of all pages of the foreign passport

- Originals of medical and payment documents for the insured event

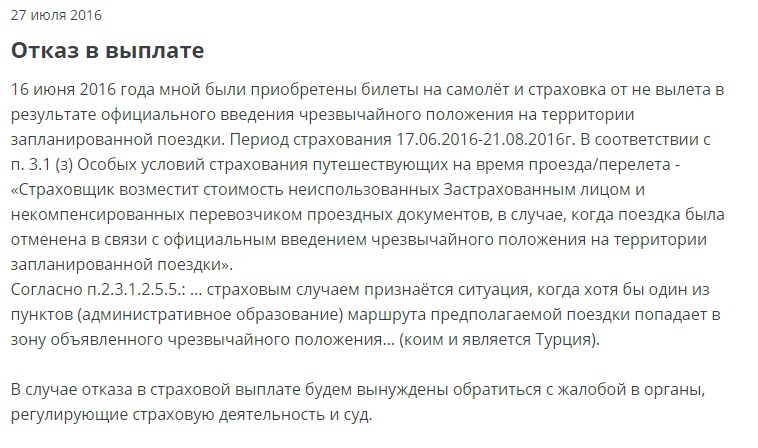

There are few reviews of payments and most of them are negative. Most often they are associated with the fact that travelers violate the terms of insurance. There are exceptions, though.

Review on Sravn.ru

Suitable for: young and healthy

Renaissance Insurance policy is suitable for young couples without children and companies. Athletes, outdoor enthusiasts and everyone who is not going to just lie down during the entire vacation will have to buy additional insurance.

The policy is not suitable for pregnant and elderly people. The insurance does not cover any complications during pregnancy, and for a person over 64 years old, the Renaissance Insurance policy cannot be issued.

I would not buy insurance from this insurance. I don't like the franchise, the confusion with the assistance, the almost mandatory additional insurance. But if you forgot to insure, then this is an option to buy "for show" the night before departure or already at the place.