Seniority is a concept familiar to a personnel officer. Despite the change in definition, this length of service plays an important role in calculating the amount of future pension payments, as well as other insurance. How the length of service is calculated, what terms of work are included in it, and what exactly it affects, will be discussed in the presented article.

The concept and types of experience

The length of service means the period during which labor and / or social activity was carried out. It includes all periods of work, starting from the first official employment. Based on it, they calculate different types compensation payments and social guarantees determined by law.

There are two parameters for calculating the length of service:

- quantitative, which determines the entire period of employment - the total length of service, replaced after the Reform with insurance;

- quality, taking into account the circumstances of the work process (the presence of harmful, dangerous and other conditions) - a special experience.

The value of accounting for years worked

Each type of seniority determines specific criteria for calculating financial benefits.

Theme of the issue

In 2018, personnel officers will have new tasks that are important to be done by a specific date. "Handbook of Personnel Officer" has prepared a calendar of personnel affairs for the year. It contains all the dates with tips on what to do.

To receive sick leave

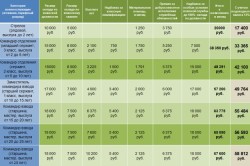

It also determines the time for the implementation of labor activity, taking into account each working day. If a citizen had several places of work, the calculation is carried out for each of them separately. The amount of payments is established on the basis of wages accrued for 1 day of work (an average is taken) and the total length of service in the following amount:

- less than six months - the amount of the allowance must correspond to the minimum wage;

- less than 5 years - 60% of salary;

- less than 8 years - 80% of salary;

- less than 10 years - 100%.

Online calculator

You can independently find out your own experience with the help of online calculators. Here you just need to enter the period of employment (dates of admission and departure). If there were several places of work, each date is entered in a separate column. After filling out, simply press the "Calculate" button and the calculator will independently determine your length of service. The risk of errors in calculations is minimal.

Is studying at the institute included in the length of service for calculating a pension

The periods included in the insurance (work) experience are given in Article 12 of the Federal Law “On insurance pensions” dated December 28, 2013 No. 400-FZ (hereinafter No. 400-FZ). In agreement with him, the list of what does not mention the period of education. Accordingly, when determining the amount of pension payments, these years are not taken into account, because insurance premiums were not paid.

Possible exceptions

Despite the fact that the period of education is not included in the list of time periods that are taken into account when determining the amount of pension payments, the legislator provides for the possibility of an exception to the rules. So, study time can be taken into account if:

- before entering an educational institution (secondary or higher), the citizen was officially employed, as there is a confirming entry in the work book;

- the student begins to work officially in parallel with his studies, and his employer begins to pay insurance premiums for him;

- a citizen receiving an education independently, of his own free will, begins to make insurance contributions to the FIU.

In the third case, you need to contact the territorial office of the PFR and conclude a formal agreement with it, according to which the amount of regular insurance payments will be determined. The frequency of their introduction is set at the request of the applicant - every month, quarter or year.

Another exception to taking into account the time of study when determining the amount of a pension is education in military schools.

Is parental leave included in retirement?

It is known that going on maternity leave allows you to save workplace to which you can return at any time. But how does the period of this type of vacation affect the length of service? Is it taken into account when the amount of the pension is set? To answer these questions, first of all, you need to understand the concept of maternity leave.

What it is

This is a leave that is provided to a pregnant woman on the basis of a disability certificate issued by the institution where she is registered. The period of leave depends on how the birth took place and how many babies were born, and can range from 140 to 194 days (Article 255 of the Labor Code of the Russian Federation). To this number of days is added the period necessary to restore health.

After closing the sick leave, a woman can write a petition for parental leave until the child reaches the age of 1.5 years, which is also paid (clause 3 of article 12 No. 400-FZ). Such leave has the right to issue not only the mother, but also the father of the child. The application is submitted on behalf of the person who is going to care for the baby.

After the child turns 1.5 years old, the leave can be extended. Since 2014, the legislator has allowed staying on maternity leave with the preservation of the workplace until the baby is 4.5 years old.

Calculation of seniority, taking into account the decree

Stay in this type of vacation in the following order:

- The period of leave on the basis of a disability certificate before and after childbirth is counted in all types of experience.

- The period of leave to care for a child until he reaches 1.5 years is also included in the calculation of all types.

But does the length of service include leave to care for a child under 3 years old? This term taken into account when calculating:

- general work experience;

- sick leave and superannuation.

However, it is not taken into account when the insurance period is established due to the fact that this period is equated to free leave. But until the child is 3 years old, and after amendments to No. 400-FZ - 4.5 years old, the workplace should be reserved for the woman.

Based on this approach, the period of maternity leave is only partially taken into account.

Service in the army is included in seniority or not

Another nuance to consider when determining your future pension payments is whether it includes the period of military service. In accordance with Part 1, Clause 1, Art. 12 No. 400-FZ, the time of performing military duty is included in all types of experience.

Inclusion of military service in seniority

Thus, the answer to the question of whether military service is included in the calculation of a pension is positive. It is important to take into account some features of such a calculation:

- registration of stay in the troops is carried out in strict accordance with its duration;

- it is possible to increase the service life for certain categories of citizens:

- twice (conscripts and civil servants);

- three times (participants in hostilities).

Based on such a calculation, the term of military service can make significant changes in the calculation of the length of service of a citizen and provide him with an early retirement.

Is military service included in the insurance period for sick leave 2017?

This time is also included in the length of service of the insurance, despite the fact that during the period of military service there are no insurance payments. In this type of experience, only the period of stay in the troops is taken into account, without the possibility of an increase. This calculation option is carried out when the volume is determined:

- pension payments;

- health benefits on the basis of a certificate of incapacity for work.

In addition, it should be noted that during the entire period of military service, a citizen retains his position and salary.

700

price

question

issue resolved

Collapse

Lawyers' answers (7)

- 10.0 rating

Lawyer, Saratov

Chat- 9.9 rating

- expert

According to part 5 of article 11 of the Labor Code of the Russian Federation:

On the territory of the Russian Federation, the rules established

labor legislation and other acts containing labor law norms apply to labor relations with the participation of foreign citizens, stateless persons, organizations created or established by foreign citizens, stateless persons or with their participation, international organizations and foreign legal entities, unless otherwise provided for by this Code, other federal laws or an international treaty of the Russian Federation.If the employee at the time of employment does not have

work book, then the employer, when concluding an employment contract, is obliged

to get him to start it (Article 65 of the Labor Code of the Russian Federation; clause 3 of the Rules for maintaining and

storage of work books, production of work book forms and providing

employers approved by the Decree of the Government of the Russian Federation of April 16, 2003 No. 225).

Records about the total (continuous) work experience of this employee in the territory of another state are not made in the work book of the Russian sample.According to Article 65 of the Labor Code of the Russian Federation, when concluding an employment contract for the first time, a work book and an insurance certificate of compulsory pension insurance are issued by the employer. Thus, if you had all documents duly executed and the employer made all deductions to the Pension Fund of the Russian Federation for that period of your work, your seniority will be counted.

Was the lawyer's answer helpful? + 1 - 0

Collapse

Lawyer, Elektrostal

Chat- 8.2 rating

Hello!

Nicholasyes, it counts, as well as experience in Ukraine. especially the Russian-style shopping mall

LETTER from Rostrud dated 06/15/2005 n 908-6-1<ОБ ОФОРМЛЕНИИ ТРУДОВОЙ КНИЖКИ ДЛЯ ИНОСТРАННОГО РАБОТНИКА>

FEDERAL SERVICE FOR LABOR AND EMPLOYMENT

LETTER

dated June 15, 2005 N 908-6-1

Question. A citizen of Ukraine, who has a temporary residence permit on the territory of the subject of the Russian Federation - the city of Moscow, presented to the employer ( entity RF) work book in Ukrainian. Do I need to continue to make entries about work on the territory of the Russian Federation in the work book Ukrainian sample in Russian, or is it necessary to get a new work book in the form approved by the Government of the Russian Federation, with an entry in it about the total (continuous) work experience of the employee on the territory of Ukraine?

Answer. The Department of Legal Support of the Federal Service for Labor and Employment reports the following.

When hiring a citizen of Ukraine, she was provided with a work book of the Ukrainian sample, that is, approved by the regulatory legal acts of Ukraine as a sovereign state.

On the territory of the Russian Federation, labor books of the established form are maintained (Article 66 of the Labor Code). Currently, on the territory of the Russian Federation there are two forms of work books that have the same force: the sample of 1974 and 2004.

Thus, the work book of the Ukrainian sample, submitted by a citizen of Ukraine, does not correspond to the form recognized in the territory of the Russian Federation, therefore, the employer must (based on the obligation to keep a work book for each employee who has worked in the organization for more than five days - part 3 of article 66 of the Labor of the Code) to create a new work book for the specified employee. At the same time, no records are made about the total (continuous) work experience of this employee on the territory of Ukraine in accordance with the work book of the Ukrainian sample in the work book of the Russian sample.

In accordance with Article 6 of the Agreement between the Government of the Russian Federation and the Government of Ukraine on labor activity and social protection of citizens of Russia and Ukraine working outside the borders of their states (dated January 14, 1993), seniority, including seniority calculated on a preferential basis, and work experience in the specialty acquired in connection with labor activity in the territories of both parties is mutually recognized by the parties. According to Article 11, documents issued in order to implement the said Agreement in the territory of one Party in the prescribed form, or their copies certified in the prescribed manner, are accepted in the territory of the other Party without legalization.

Head of Department

legal support

Federal Service

for work and employment

I.I.SHKLOVETSWas the lawyer's answer helpful? + 2 - 0

Collapse

Clarification of the client

At the time when I worked under an employment contract in the Russian Federation with a work permit foreign citizen(2007 and 2008), I was in the status of a foreign citizen temporarily residing in the Russian Federation (in accordance with Article 2 of the Federal Law No. 115-FZ "On the Legal Status of Foreign Citizens in the Russian Federation" dated July 25, 2002). Now I am retiring. The Pension Fund does not count these years of work as seniority, referring to the fact that in accordance with Article 7 of the Federal Law "On Compulsory Pension Insurance in the Russian Federation" dated 15.12.2001 No. 167-FZ, as amended, in force until 01.01. citizens of the Russian Federation, as well as foreign citizens and stateless persons permanently or temporarily residing in the territory of the Russian Federation. The organization where I worked did not transfer contributions to the Pension Fund for the employee (me) until the moment when I received Russian citizenship (December 2008), referring to the fact that only from 01/01/2012 in Article 7 of the Federal Law "On Compulsory Pension Insurance in of the Russian Federation" amended, according to which foreign citizens temporarily staying on the territory of the Russian Federation, in accordance with the concluded labor contracts for an indefinite period or for a period of at least six months, are insured persons - i.e. insurance contributions to the Pension Fund were received only from the moment I took citizenship of the Russian Federation (December 2008). Are the interpretations of the PF and the employer legal? How to do it right?

Lawyer, Moscow

Chat- 10.0 rating

- expert

Does the period of work of a foreign citizen (Ukraine) in the Russian Federation (2007-2008) count as work experience? In the work book there is a mark on work since 2007 (issued in the Russian Federation). Since 2008 he became a citizen of the Russian Federation.

NicholasGood afternoon.

Yes, it counts, the most important condition is that insurance premiums to the Pension Fund of Russia are paid.

GOVERNMENT OF THE RUSSIAN FEDERATION

RESOLUTION

dated October 2, 2014 N 1015

ABOUT THE APPROVAL OF THE RULES

INSURANCE PENSIONS

REGULATIONS

CALCULATION AND CONFIRMATION OF INSURANCE EXPERIENCE TO ESTABLISH

INSURANCE PENSIONS

VI. Confirmation insurance experience during the period

after registering as a citizen

insured person

43. The periods of work and (or) other activities after the registration of a citizen as an insured person are confirmed by documents on the payment of the relevant mandatory payments issued in the prescribed manner by the territorial body of the Pension Fund of the Russian Federation on the basis of information from an individual (personalized) account.

VII. Features of confirming the insurance experience of individual

categories of insured persons

44. If the insured person is a recipient of a pension in accordance with the legislation of a foreign state, information about the periods taken into account when establishing such a pension is confirmed by a document issued by the body providing pensions in this state, or by another organization whose powers include issuing such documents.

45. If, in order to calculate the length of service required for acquiring the right to an old-age insurance pension, information is required on the receipt of a seniority pension or a disability pension in accordance with the Law of the Russian Federation “On pension provision for persons who have served in the military, served in bodies of internal affairs, the State Fire Service, bodies for control over the turnover drugs and psychotropic substances, institutions and bodies of the penitentiary system, and their families” and on periods of service preceding the appointment of a disability pension, periods of service, work and (or) other activities taken into account when determining the amount of pension for long service in accordance with the specified By law, such information is confirmed by a certificate from the body providing pensions in accordance with this Law, in the form in accordance with Appendix No. 6.

49. The length of service does not include periods taken into account when establishing a pension in accordance with the legislation of a foreign state.64. If the name, patronymic or surname of a citizen in the document on insurance experience does not match his name, patronymic or surname indicated in the passport or birth certificate, the fact that this document belongs to the citizen is established on the basis of a marriage certificate, certificate of name change, certificates of the competent authorities ( officials) of foreign states or in a judicial proceeding.

Sincerely,

Vasiliev Dmitry.Was the lawyer's answer helpful? + 0 - 0

Collapse

Lawyer, Saratov

Chat- 9.9 rating

- expert

Are the interpretations of the PF and the employer legal?

Unfortunately, Nikolai, amendments to Article 7 167-FZ regarding “temporary stay” were introduced precisely from 2012 by the Federal Law of December 3, 2011 N 379-FZ “On Amendments to Certain Legislative Acts of the Russian Federation Concerning the Establishment of Insurance Contribution Tariffs” to state non-budgetary funds”:

a) in the first paragraph, the words "Insured persons are citizens of the Russian Federation, as well as foreign citizens and stateless persons permanently or temporarily residing on the territory of the Russian Federation" shall be replaced by the words

“Insured persons are citizens of the Russian Federation,

permanently or temporarily residing on the territory of the Russian Federation

foreign citizens or stateless persons, as well as foreign

citizens or stateless persons (with the exception of

highly qualified specialists in accordance with the Federal Law of July 25, 2002 N 115-FZ "On the Legal Status of Foreign Citizens in the Russian Federation") temporarily staying on the territory of the Russian Federation who have concluded an employment contract for an indefinite period or a fixed-term employment contract for a period of at least six months”;Prior to this, the wording was different (specified above). Thus, the interpretation of the RF PF is correct.

Was the lawyer's answer helpful? + 0 - 0

Collapse

Clarification of the client

It turns out that if I worked at the time when I was in the status of "temporarily staying on the territory of the Russian Federation" (Law of July 25, 2002 N 115-FZ "On the legal status of foreign citizens in the Russian Federation") and

in Article 7 of 167-FZ "On Compulsory Pension Insurance in the Russian Federation" (dated December 15, 2001), there was not a word about "temporary stay", it did not work at all !!! But what about, an official work permit, permanent residence at the place of registration (actual residence), a documented work book, insurance premiums (in favor of a resident -13%, in favor of a non-resident - 30%). The Law of the Russian Federation No. 167-FZ "On Compulsory Pension Insurance in the Russian Federation" was not repealed, it was only edited (specified) a number of times, and only in 2012 "temporarily staying" foreign citizens are insured persons, i.е. they accrue and pay contributions to the PF, etc., the length of service is counted. Sorry for the comparison, then the combatants, liquidators, etc. also should not be equated with those, the law did not exist at the time of their actions, it is then published, edited. How to understand?

received

fee 100%

Lawyer

Chat

Good evening.

Yes, it counts.

Federal Law No. 400-FZ of December 28, 2013 “On Insurance Pensions”

Article 11

1. The length of service includes periods of work and (or) other activities that were carried out on the territory Russian Federation by the persons specified in Part 1 of Article 4 of this Federal Law, provided that for these periods insurance premiums were accrued and paid to the Pension Fund of the Russian Federation.

3. Foreign citizens and stateless persons permanently residing in the Russian Federation, subject to their observance of the conditions provided for by this Federal Law, are entitled to an insurance pension on an equal basis with citizens of the Russian Federation, except in cases established by federal law or an international treaty of the Russian Federation.

In addition, according to Art. 6 "Agreements between the Government of the Russian Federation and the Government of Ukraine on labor activity and social protection of citizens of Russia and Ukraine working outside the borders of their states" (Concluded in Moscow on January 14, 1993)

Employees of the Party of departure working in the territory of the Party of employment enjoy the rights and fulfill the obligations established by the labor legislation of the Party of employment (including issues of labor relations, collective agreements, remuneration, working hours and rest periods, protection and working conditions, and others).

The length of service, including the length of service calculated on a preferential basis, and the length of service in the specialty, acquired in connection with labor activity in the territories of both Parties, is mutually recognized by the Parties.

The length of service is calculated according to the legislation of the Party in whose territory the labor activity was carried out.

The Parties recognize diplomas, certificates and other documents of the state standard on the level of education and qualifications issued by the relevant competent authorities of the Parties, without legalization.

Thus, there are no obstacles to the exclusion of the specified period of labor activity from the work experience of the employee.

Was the lawyer's answer helpful? + 3 - 0

Collapse

All legal services in Moscow

- The basic concept of work experience

- Types of military pensions

- The procedure for applying for a military pension

- Appointment of a second pension

Whether contract service is included in the length of service, many servicemen of the Russian army would like to know. The fact is that in our country the pension legislation has changed several times. As a result, there were changes in the order of pensions for military personnel. In this regard, information on whether service under the contract is included in the length of service is relevant.

The basic concept of work experience

From the point of view of legislation, seniority is understood as the period of labor activity of a citizen of the Russian Federation. At the same time, in addition to direct labor activity, a citizen during this period can also be credited with the time when he actually did not conduct such activity for good reasons.

In addition, there is such a thing as insurance experience. This is the period when the employer or the citizen himself paid insurance premiums to the Compulsory Fund social insurance. During this time, a certain amount is accumulated on a special individual account, which is taken into account when calculating and paying a pension.

It is worth noting that until 2015 the law used only the concept of seniority in order to calculate a pension. However, after the adoption of the new Federal Law “On insurance pensions”, only the concept of insurance experience is used for the purpose of calculating it. It depends on how long the employer pays insurance premiums for the employee.

It is worth noting that until 2015 the law used only the concept of seniority in order to calculate a pension. However, after the adoption of the new Federal Law “On insurance pensions”, only the concept of insurance experience is used for the purpose of calculating it. It depends on how long the employer pays insurance premiums for the employee.

In connection with this circumstance, all military personnel leaving for a well-deserved rest should be aware that the accrual of a pension for them, if they left the service before the named period, will be carried out taking into account the previous legislation. If they were demobilized after the introduction of the new law, all work on the appointment of pension payments to them will be carried out on the basis of the new act.

In addition, it is worth remembering that the rules for calculating pension payments to military personnel are mainly established by the Federal Law “On the Status of a Serviceman”. For civilians, such payment is established by other laws, although there are some cases when the said law will not be applied.

Back to index

Types of military pensions

There are several types of military pension payments:

There are several types of military pension payments:

- by disability;

- for years of service;

- family members of a serviceman on the loss of a breadwinner.

Wherein this species payments can be assigned to the following persons if they perform military service in:

- Ministry of Defense;

- the Ministry of the Interior;

- Federal Service for the Execution of Punishments;

- FSKN.

It is worth knowing that a soldier can receive the right to a military pension upon reaching 20 years of service. If he has not served so many years, he will be assigned a mixed pension, which also takes into account the period of his work in civilian life. At the same time, the length of service is credited to the same contract servicemen on the basis that one day of service is equal to one day of work. For the conscripts this indicator equals one to two.

It is worth knowing that a soldier can receive the right to a military pension upon reaching 20 years of service. If he has not served so many years, he will be assigned a mixed pension, which also takes into account the period of his work in civilian life. At the same time, the length of service is credited to the same contract servicemen on the basis that one day of service is equal to one day of work. For the conscripts this indicator equals one to two.

At the same time, the Government of the Russian Federation may establish by its decree a list of those regions in which service gives the right to calculate the length of service according to a different system, in which case one day can go for three. Basically, these are areas of military operations or places of special operations. At the same time, the procedure for the stay of law enforcement officers in such regions can be established directly by the command of the ministry or department in which they serve.

Back to index

The procedure for applying for a military pension

According to the current legislation, a person who has been dismissed from service and has reached the age of 45 on the day of dismissal can apply for a military pension.

A person must serve at least 12 years with a total work experience of 25 years or more.

At the same time, some military personnel believe that while the service is under contract, the work book is not needed, since it is replaced by a military ID or certificate. This is not true. The fact is that, of course, a serviceman is not an employee under an employment contract and all entries are made on his military ID, but there are other types of service in which a work book is issued, for example, in the Ministry of Internal Affairs. Therefore, if you do not know anything about the issue of contract service and employment, you should clarify this issue in advance, before retirement.

In the standard case, the former defender of the patronymic will have to provide a military ID and a certificate stating that he served in regions that give the right to a preferential pension for assigning pension payments to him. Such a certificate can be obtained from the military commissariat, military unit and the state archive.

In addition, former military personnel can count on various additional payments, for example, for disability, maintenance of dependent family members who are unable to work.