Many young people already from adolescence strive for independence and start working. But saving for a car by the age of 18 is still extremely problematic, and not everyone can borrow from relatives and friends. There is only one way out -.

The minimum age threshold is one of the requirements for borrowers in almost every bank. Only a few financial institutions are ready to issue a car loan from the age of 18, as a rule, banks consider loan applications only if a citizen has already reached the age of 21.

There are several reasons for the wariness of Russian banks towards borrowers who have just crossed the threshold of majority. It:

- Lack of a permanent source of income. Few of the citizens aged 18 years can boast of having a constant source of income and sufficient earnings to fulfill car loan payments.

- Lack of stable performance and work experience... By the way, not every bank is ready to issue a loan to a 30-year-old borrower if he has no work experience of less than a year.

- Young people run the risk of being drafted into the army, making it impossible to repay the loan.

- A more frivolous attitude towards money, lower financial discipline.

Conditions for granting a car loan at 18

Car loans involve a fairly large amount of money, which makes it even more difficult for those who are just 18 years old to get them approved. After all, the larger the loan amount, the higher the bank's risks in case of non-return.

Car loans involve a fairly large amount of money, which makes it even more difficult for those who are just 18 years old to get them approved. After all, the larger the loan amount, the higher the bank's risks in case of non-return.

Even those banks that are ready to provide a loan to a borrower at the age of 18, pledge their risks in the form of an increased interest rate. It can be higher than for a standard car loan program by 1-3%.

Who will find it easier to get a car loan at eighteen? Those who already work in a successful company and have officially confirmed income. In many banks, the list of mandatory documents includes copies of an employment contract or work book, as well as a certificate of income.

If the borrower already has an impressive amount of his own savings, and the loan amount is no more than 50% of the cost of the car, then it will be possible to do without confirmation of income.

Some banks make it mandatory for young clients to have guarantors. Usually they are the parents of the borrower. In case of non-payment of the loan, they will be charged with the entire credit burden.

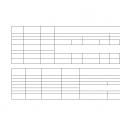

Which banks give car loans at 18

Car loans for young people over the age of 18 are provided by the following Russian banks.

- In Promregionbank, car loans are issued to citizens aged 18 to 65 years. The Autostandard program allows you to receive up to 1.5 million rubles. at down payment more than 10%. Proof of income is required. The interest rate on the loan is 20-23%.

- In Rosselkhozbank it is also possible to get a car loan at the age of 18. But before coming of age, the borrower must already have a year of work experience. The interest rate ranges from 22 to 27%. The minimum contribution is from 20%.

- Moscow credit bank issues car loans from 120 thousand rubles. up to 4 million rubles borrowers from 18 years old. Loans are provided for up to 7 years. Interest rates range from 16 to 30.5%. With a contribution from own funds less than 10% of the cost of a car, the maximum loan amount is up to 1 million rubles. Additionally, proof of employment and income will be required.

- In Promtransbank under the "New Cars" program, you can get a loan of up to 1.5 million rubles. The minimum contribution must be 20%. The interest rate is quite high - 37-38%.

Although these banks set a minimum age of 18 years for obtaining a loan, this does not mean at all that such a young borrower will be approved for a loan.

To buy a car on credit, it is not necessary to use car loan programs. You can take the usual non-target consumer credit... It is received according to a simplified program, and the requirements for borrowers are more loyal.

True, the loan amounts in this case are lower, and the rates are even higher. Consumer loans over the age of 18 are issued by Sberbank, Modern Commercial Bank, MTS-Bank.

Applying for a loan at the age of 18 is an act quite in the spirit of today's reality. Young people want to afford much more than is possible thanks to their parents or part-time jobs. Dozens of large banks are ready to issue cash loans to young girls and guys who have barely stepped on the threshold of majority.

Some of the financial institutions are doing completely inexplicable things, offering cash loans to 18 young people without providing proof of income and without requiring guarantees for them from wealthier and more mature people.

Banks issuing cash loans from the age of 18

Credit Bank of Moscow - rate from 15% per annum

- Amount - up to 3,000,000 rubles

- Term - up to 15 years

- Guarantee - not required

Tinkoff Bank - rate from 15% per annum

- Amount - up to 300,000 rubles

- Income statement - not required

- Term - up to 15 years

- Guarantee - not required

- Online application is possible

Bank "Ak Bars" - from 15.5%

- Guarantee - not required up to 1,000,000 rubles

- Term - up to 5 years

- Online application is possible

- Amount - up to 3,000,000 rubles

- Cities - Barnaul, Yekaterinburg, Izhevsk, Krasnodar, Krasnoyarsk, Kazan, Kemerovo, Moscow, Nizhny Novgorod, Orenburg, Perm, Pskov, Novosibirsk, Omsk, Rostov-on-Don, Ryazan, Saransk, Stavropol, Tyumen, Samara, St. Petersburg, Ulyanovsk, Chelyabinsk, Yaroslavl, Ufa, Cheboksary.

Ji Money Bank (only for girls) - from 16.9%

- Amount - up to 500,000 rubles

- Term - up to 5 years

- Certificate of income - not required up to 300,000 rubles

- Online application is possible

- Guarantee - not required

- Cities - Vladimir, Yekaterinburg, Kazan, Kaluga, Kostroma, Krasnodar, Moscow, Nizhny Novgorod, Novosibirsk, Pskov, Rostov-on-Don, Ryazan, Samara, St. Petersburg, Tver, Tula, Ufa, Cheboksary, Chelyabinsk, Yaroslavl

Khanty-Mansi Bank - from 17.5%

- Guarantee - not required

- Term - up to 7 years

- Online application - possible after registration on the bank's website

- Certificate of income - in the form of a bank or 2-NDFL

- Amount - up to 750,000 rubles

- Cities - Yekaterinburg, Kurgan, Moscow, Salekhard, St. Petersburg, Khanty-Mansiysk

MTS-Bank - from 17.9%

- Amount - up to 1,000,000 rubles

- Certificate of income - in the form of a bank or 2-NDFL

- Term - up to 5 years

- Guarantee - not required

- Online application is possible

- Cities - Barnaul, Volgograd, Voronezh, Yekaterinburg, Irkutsk, Birobidzhan, Vladivostok, Kazan, Kaliningrad, Krasnoyarsk, Moscow, Novosibirsk, Kirov, Krasnodar, Omsk, Penza, Samara, St. Petersburg, Saratov, Perm, Rostov-on-Don, Syktyvkar, Tomsk, Chelyabinsk, Chita, Tyumen, Khabarovsk, Yakutsk, Yaroslavl

Rosselkhozbank - from 18.5%

- Term - up to 5 years

- Cities - all major cities in Russia

- Amount - up to 1,000,000 rubles

- Certificate of income - in the form of a bank or 2-NDFL

- Surety - required

Sberbank - from 19.5%

- Term - up to 5 years

- Certificate of income - in the form 2-NDFL

- Surety - parental surety is required from 18 to 20 years old

- Online application - not provided

- Amount - up to 3,000,000 rubles

Expert Bank - from 24.9%

- Term - up to 3 years

- Guarantee - not required

- Online application - not provided

- Amount - up to 200,000 rubles

- Certificate of income - a certified copy of the employment contract is required

Leto Bank (only for girls) - from 29.9%

- Guarantee - not required

- Amount - up to 500,000 rubles

- Online application - not provided

- Income statement - not required

- Term - up to 4 years

Miraf-Bank - from 32.85%

- Online application - not provided

- Term - up to 1 year

- Certificate of income - required in the form 2-NDFL

- Guarantee - not required up to 300,000 rubles

- Amount - up to 500,000 rubles

Moscow students can expect to receive a consumer loan upon reaching the age of 18 at the Moscow Credit Bank. A prerequisite for a positive solution to the issue is the presence of Russian citizenship, permanent registration and a stable income. Of the required documents - the provision of a passport. But this is valid only if the loan amount does not exceed 1,500,000 rubles. The interest rate on this loan ranges from 15% to 34% per annum (those who have just celebrated their 18th birthday should lean towards the last figure).

GI Money Bank also treats 18-year-old borrowers favorably, without insisting on guarantors and certificates of wages. To get 300,000 rubles, they only require a passport, so even the unemployed can lend. True, there is one "but" - only girls can take advantage of such an offer, and young people are credited only from the age of 21.

If the solution to financial problems is urgent, MTS-Bank or Expert Bank will come to the rescue. These institutions operate programs with names that speak about themselves independently - "Express Credit" and "Fast Money".

Girls who have reached the age of 18 can receive the required amount of money at Leto Bank. But guys who want to replenish the budget will have to postpone their trip to the bank until their 21st birthday. All three banks make a decision on granting or not providing credit funds very quickly - on the day of application, within an hour.

If there is a guarantor, for example, one of the parents and providing a certificate of income in the form of 2-NDFL, a loan at the age of 18 will give a positive result in Sberbank of Russia.

The rest of the big banks do not offer student loans. For example, the bank "Petrokommerts" can lend at the age of 18 only on the security of liquid assets. And UniCredit Bank gives loans to 19-year-old clients on the condition that they receive a salary on the card of the lending bank.

The following banks issue loans from the following age:

- Uniastrum Bank - issues loans from 21

- Revival - from 21

- UniCredit Bank - from 21

- Promsvyazbank - from 23

- St. Petersburg - from 21

- Uralsib - from 23

- Raiffeisenbank - from 23

- Home Credit - from 23

- VTB 24 - from 21

- Trust - from 23

- Opening - from 23

- Nomos-Bank - from 21

- Alfa-Bank - from 21

- Svyaz-Bank - from 23

- Rosbank - from 22

- Bank of Moscow - from 21

- Eastern Express bank - from 21

- Russian Standard - from 25

Nowadays, many young people gain independence early - barely reaching the age of 18. And often they need financial support because they want to buy housing, start their own business, etc. But, since banking structures are reluctant to cooperate with young people, they have to look for banks for a long time, which, without refusal, give consumer loans from the age of 18 without providing certificates of income and guarantors.

Banks where you can get a loan at 18

As a rule, the youngest clients of banks are people over the age of 21. This is due to the fact that upon reaching given age they have a profession, a steady income, and consciously turn to banks, taking responsibility for paying off debt. However, there are banking structures willingly issuing cash loans clients over the age of eighteen.

Below is a list of banks where you can easily get consumer loan at 18.

Credit Bank of Moscow (MCB)

This financial structure cooperates with citizens exclusively on the territory of Moscow and the Moscow region. Provides a unique opportunity obtaining a credit loan at the age of 18 for up to two million rubles.

Only in this bank the borrower can repay the loan in a record long term - 15 years. The application, the decision is made within 1 to 72 hours.

A loan can be issued using two documents: a passport and driver's license (or another document of your choice). If the application is approved, the requested amount is transferred to a plastic card, which is accepted at any MKB ATM.

Post Bank

The organization created by Russian Post and VTB financial group has maximum amount branches on the territory of the Russian Federation.

Is an ideal option for clients, since it issues cash loans to clients aged 18 and over who find it difficult to submit a statement of income.

To draw up an agreement, you must have a passport and SNILS with you. The decision to issue a cash loan is made instantly, the money is issued to the client on the day of application.

![]()

Renaissance Credit Bank

It is a popular banking structure that issues loans without collateral, certificates and guarantors to citizens who have reached the age of 18. Maximum amount the loan is 700,000 rubles, while proof of income is not required. The loan is issued for a period of up to 5 years at an attractive low interest from 12.9%.

Tinkoff Bank

It is a popular Internet bank, as well as a leader in this type of lending. Provides cash loans to citizens who have reached the age of 18, under two programs:

- getting a credit card;

- obtaining a loan in cash to the card account.

Both programs can be obtained by providing only a passport. Under a special program for young people, the interest rate has a higher index, while the loan amount is limited.

Credit card. You can get a loan of up to 300 thousand rubles for a period of 36 months. The loan rate is 15.9% per annum. There is a grace period of 55 days, during which the minimum monthly payment is only 8% of the amount owed. if the application is approved, the card is delivered by courier within a week to the office or home.

Consumer loan. The loan term also does not exceed 36 months, but its amount increases, which is 1 million rubles. A feature of this program is a pre-approved fixed payment schedule.

If it is not possible to get a loan from each of these structures, you can use other methods of obtaining it.

Additional ways to get a loan at 18

Along with the traditional options for obtaining a loan, there are alternative additional ways, as to takeconsumer credit in age 18 years:

- loan with a guarantee;

- contacting the MFO.

Bring a guarantor and arrange a loan at Sberbank

Sberbank is the largest banking structure in Eastern Europe, providing loans to 18-year-olds, subject to the surety of one of the close relatives or parents.

Having branches in almost all cities, it offers cash loans in the amount of 15 thousand - 5 million rubles at a low interest rate of 12.9-19.9% \u200b\u200bper year. The maturity of the debt is 5 years, which allows you to return funds in small amounts. The decision to issue a loan is made within two working days. Funds are issued in cash on the day of approval.

Get a loan from a microfinance organization (MFI)

It is considered the easiest and at the same time the most expensive way to obtain a cash loan. Virtually all organizations issue loans to eighteen-year-olds after providing only one passport.

The main advantages of microloans are: filing an online application, and issuing funds on the day of circulation. However, it should be noted that the interest rate is high and ranges from 1 to 2.5% per day.

Conclusion

Summing up and togas, it should be noted that 18-year-old citizens have ample opportunities to get both a cash loan and credit card... However, when choosing a partner bank for drawing up an agreement, you should study the terms of lending so that later you do not overlook high commissions for low interest rates.

You will also be interested in:

7 best banks that give lucrative loans pensioners

7 best banks that give lucrative loans pensioners

Top 10 banks offering cash loans for 7 years

Top 10 banks offering cash loans for 7 years

Coming of age is a reason to think about the future. This is the time when young people do a lot, and every day starts with new ideas and plans. Can I get a loan at 18? If you are independent enough, and are ready to take responsibility for all actions, then you will not have any difficulties with the transaction.

How can you simplify the procedure and save time? Use our service to apply for a cash loan from 18 years old to all banks in your city at the same time. We will help you:

- obtain reliable background information on various banking products available to adult clients;

- calculate the overpayment and monthly payment using the special option "Loan Calculator" and make your choice;

- request the required amount via the Internet at once in all suitable financial institutions of the nearest large settlement.

Banks that provide cash loans from the age of 18 are ready to take on certain risks associated with the late return of credit funds. therefore interest rates for this type of banking services may be higher than for standard programs. However, by submitting applications through our website, young people get the opportunity to reduce the time for preliminary clarification of the terms of the transaction, avoid difficulties in finding guarantors and collateral and take out a loan without official employment.

In what cases will our service be useful?

Having decided to apply for a loan, young people face significant difficulties, since not all banks have programs that take into account the needs of this client segment. As a rule, financial institutions avoid cooperation with individuals under the age of 21. Thanks to our site, young people can become a full participant in credit relations immediately upon reaching the age of majority.

You can request funds from the bank for any purpose:

- to study at a university;

- for the purchase of seasonal clothing and footwear;

- to pay for tourist trips, spa treatment, and more. dr.

The lack of information about a potential borrower in the BCI database cannot serve as a reason for refusal - the application service is available to all users who have reached the age of majority. It should be borne in mind that with the help of the site it is quite possible to take a loan from 18 years without work. However, young people will need a steady income to service their debt. If the budget of the potential borrower is not yet calculated for monthly payments to the bank, it is better to refuse the deal.

We accept applications from netizens in remote mode around the clock. Do you want to receive information about which banks are issuing loans from the age of 18 and declare your desire to complete a financial transaction? Use our service right now, and your application will be sent simultaneously to all credit institutions in the nearest city. We are waiting for you on our website at any time of the day!