In domestic banking terminology, there are two concepts that characterize the cost of liquidity provided by the Central Bank: refinancing rate and key interest rate... Despite the fact that these concepts are close to each other in meaning, their meanings are not identical and have a number of fundamental differences. So, let's see what exactly their similarities are, and what are the differences.

The Law "On the Central Bank Russian Federation (Bank of Russia) ”No. 86-FZ, the main instruments of the country's monetary policy have been identified, including the establishment of interest rates on operations of the Central Bank of the Russian Federation, and refinancing (lending) of banks, and operations on the open market, and a number of others. At a meeting of the Board of Directors of the Bank of Russia, the official interest rate for the provision of resources to credit institutions is established, on the basis of which the scale of interest rates for the Central Bank's operations is already being formed. Based on the orientation of monetary policy in the use of one or another of its instruments, the basic rate of bank interest may have a different name: refinancing rate, discount rate, key rate.

Refinancing rate: definition and application

For the first time, as an instrument of regulation of the Central Bank's policy, the refinancing rate was established by the Central Bank Telegram dated December 29, 1991 No. 216-91 and came into effect on January 1, 1992. She determined the cost of loans from the Bank of Russia for all commercial banks in the country. Since then, the refinancing rate began to reflect the level of payment for credit resources provided by the Central Bank of the Russian Federation to other banks, in other words, to characterize the Central Bank's lending operations or refinancing operations.

Refinancing of the banking sector can be carried out through the provision of intraday loans, overnight loans, lombard loans, as well as loans secured by gold or non-marketable assets of the Central Bank. Since 2003, after the publication of the Central Bank Telegram No. 1296-U, the refinancing rate began to determine the upper limit of interest rates on active operations (liquidity provision operations) of the Central Bank in the money market, since the rates on overnight loans (overnight loans) were adjusted to its level. ").

In this way, refinancing rate is a percentage indicator expressed on an annualized basis that characterizes the chargeability of credit resources provided by the Central Bank (refinancing). Determining one or another of its value, the Central Bank influenced the level of interest rates on interbank transactions, as well as on bank deposits and loans.

However, in addition to the main function of economic regulation, the refinancing rate also performs additional functions... In particular, it is used in the calculations of taxes and fees, is used under the terms of contracts for calculating penalties, for calculating penalties and penalties for taxes, fines, court orders and other payments. Until September 13, 2013, the refinancing rate was of decisive importance for the designation of the vector of the country's economic development. However, with the introduction in September 2013 by the Bank of Russia Board of Directors, a key interest rate (Information from the Bank of Russia dated 13.09.2013) (link: http://www.cbr.ru/press/pr.aspx?file\u003d130913_1350427l.htm), the discount rate has become of secondary importance, performing only its additional functions (for example , fiscal).

Fiscal implications of the refinancing rate

The Tax Code contains numerous references to the application of the Central Bank's refinancing rate in calculations. Those. in accordance with the provisions of the Tax Code, it is used to calculate the taxes payable, as well as fines and penalties on them. This is its fiscal meaning. Most often, the refinancing rate is used to determine:

· The taxable base for income received in the form of material benefits from savings on interest on loans (Article 212 of the Tax Code of the Russian Federation).

· Income taxable by personal income tax on bank deposits (article 214.2 of the Tax Code of the Russian Federation, clause 27 of article 217 of the Tax Code of the Russian Federation);

· Income and justified expenses for the purpose of calculating corporate income tax. In particular, for calculating interest expenses on debt obligations and the range of their permissible values \u200b\u200b(Article 269 of the Tax Code of the Russian Federation). However, the changes made to Art. 269 \u200b\u200bof the Tax Code of the Russian Federation by the Federal Law of March 8, 2015, established in some cases the use of the key rate of the Bank of Russia for calculating the interval;

· Penalties for late payment of taxes (parts 1 and 2 of the Tax Code of the Russian Federation).

Key rate bank interest

Key rate - This is the interest rate for the provision and withdrawal of liquidity by the Central Bank on an auction basis for up to seven days. It was put into effect on September 13, 2013 in order to improve the methods of regulating the monetary policy of the Central Bank of the Russian Federation, and has since been used as its main instrument (Information of the Central Bank "On the system of interest rate instruments of monetary policy" dated September 13, 2013 No. ). The mechanism for using the key rate assumes the impact of the Bank of Russia on short-term transactions (from 1 to 7 days).

According to the Information of the Central Bank of the Russian Federation dated September 13, 2013, at the key rate, the Central Bank provides banks with liquidity on the basis of REPO auctions for a period of one week - securities purchase and sale transactions. Along with the definition of the key rate, the Bank of Russia also introduces the concept of an interest rate corridor, the width of which is two percentage points. The upper and lower boundaries of the interest rate band are operations at fixed interest rates to provide and withdraw liquidity, respectively. The key rate determines the middle of the range. In addition, floating borrowing rates are also tied to the key rate. By raising or lowering the key rate, the Central Bank influences the level of interest rates in the money market, and, consequently, the level of bank liquidity, the volume of money supply in the economy, the level of inflation and the rate of economic growth.

Differences between the refinancing rate and the key interest rate

Thus, both the refinancing rate and the key interest rate are the main instruments of the monetary policy of the Bank of Russia, applied in different periods of time, and in a certain way describing the cost of liquidity provided to banks. The distinctive features of these two concepts are presented below:

|

Refinancing rate |

Key interest rate |

|

|

Period of use by the Central Bank as the main instrument of monetary policy | ||

|

What does |

Maximum (upper) rate on Bank of Russia operations |

The middle of the Bank of Russia interest rate corridor |

|

Reflects the cost of what transactions of the Central Bank |

Overnight loans |

REPO auctions for 1 week |

|

Additional functions |

It is used for calculating penalties, fines and penalties, for calculating taxes |

It is used to calculate the interval of the limit values \u200b\u200bof interest on debt obligations (Article 296 of the Tax Code of the Russian Federation) |

Recently, due to the developing world financial crisis, more and more people are interested in the economy, its indicators, terms and concepts. In this regard, many questions arise, among which one of the leading places is occupied by the difference between the refinancing rate and the key rate. To begin with, we will give a decoding of these concepts.

Key rate - This is an indicator that determines the amount of interest of the Central Bank on short-term weekly loans provided to banks. Also, this value is decisive for deposits that the Central Bank accepts from banking institutions. This indicator is the main regulator of the inflation rate and investment attractiveness.

Refinancing rate Is the annual interest rate on loans borrowed by credit institutions from the Central Bank of Russia. Today, the role of this financial and economic indicator is secondary, it is used to calculate fines and penalties.

Impact of changes in the lending rate of the Central Bank of Russia

Until 2013, there was no such thing as a discount key rate in the Russian economy. Instead, the key role was played by the refinancing rate, which was first introduced in 1992.

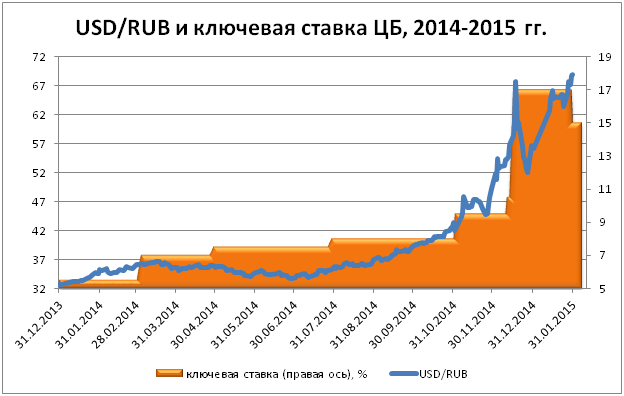

On September 13, 2013, in order to control inflation and increase investment attractiveness, the Central Bank simultaneously introduces a key rate and determines its size of 5.5%. Until December 2014, statistics recorded an increase in this indicator, after which a gradual decline began, and at the moment its size is 11%.

The impact of the key rate on the economy is as follows. It forms the amount of bank loans that are issued to individuals and legal entities... In addition, with its help, inflation is adjusted, and the volume of resources attracted by commercial banks is determined.

To reduce inflation, the Central Bank uses an increase in the key rate. The mechanism of influence can be understood as follows.

The consequence of the increase is a change in the direction of an increase in interest rates on deposits and loans, including mortgages, which are provided by banks. Naturally, purchasing power falls, the pressure of the ruble decreases, and the dynamics of inflation slows down.

This is one of the options for using the increased key rate. Another could be seen at the end of 2014. Then the Central Bank decided to raise its value by 70% from 10.5 to 17%. This move significantly limited access to short-term lending for commercial banks. The result was a decrease in the number and volume of speculation in the foreign exchange market, which also led to inflation, due to the lack of borrowed ruble stock.

If the country's economy is in a state of stagnation, production and business activity decreases and deflation starts because of this, a decision is made to reduce the rate. This reduces the cost bank loan, which, in turn, stimulates lending to the real sector of the economy.

Differences between the refinancing rate and the key rate

What is the role of the refinancing rate?

Today its practical role boils down to the following:

1. Determines the need for taxation on deposits in rubles and foreign currency, if their interest rate exceeds the refinancing rate by 5% (in the case of deposits in foreign currency - by 9%)

2. Calculation of the daily penalty charged for late payment of tax levies. It is calculated as 1/300 of the refinancing rate.

3. If the amount of accrued interest was not specified in the loan agreement, they are determined by the level of the refinancing rate on the day of the conclusion of the agreement.

4. Calculation of the amount of penalties imposed on the employer for each day of delay in the payment of wages, vacation pay, sick leave and other charges to employees. It is also equal to 1/300 of the part.

Until 2013, she played a key role in the conduct of monetary policy.

1998 is a historical example of her work. The Central Bank of Russia used the size of the refinancing rate to correct the financial sector of the Russian economy.

Starting from May and up to the crisis that gripped the Russian economy in August, the refinancing rate rose several times. In this way, the Central Bank stimulated the acquisition of new government securities, demonstrating a high level of their profitability. However, the outbreak of the crisis showed the ineffectiveness of such actions, so a decision was made to revise the monetary policy, soften it and reduce the rate.

The difference between the level of the key rate and the refinancing rate of the Central Bank of Russia

Until the fall of 2014, when there was a significant jump in the key rate, the values \u200b\u200bof these two indicators did not differ significantly from each other. But the collapse of oil on world markets and the subsequent fall in the Russian currency forced the interest rate to be raised, significantly increasing its gap with the refinancing rate, which currently stands at 8.8%.

This resulted in a controversial situation. The relatively small size of the refinancing rate made it unprofitable for the borrowers to fulfill their debt service obligations. The default interest rate was significantly lower than the rate for refinancing debt. That is, it became more profitable for creditors to accumulate interest than to take new loan to pay off current liabilities.

This situation can be corrected by increasing the refinancing rate to the level of the key rate. This will increase the amount of interest charged to the level of interest on loans, which should stimulate borrowers to repay rather than accumulate debt.

But this increase is only planned for 2016. Therefore, the current policy. Conducted by the Central Bank, it leads to the conclusion that at the moment the problem of growing arrears is below the ability to manage inflation in the country.

The economic growth of most countries in the world depends on how competently the policy of the Central Bank is carried out. One of the main instruments used by the Central Bank different countries is the key rate.

The Russian Central Bank is no exception. But he introduced this term into the practice of his work relatively recently, replacing it for many years with the phrase "refinancing rate". The key rate becomes one of the main regulators of the country's economy, turns into a subject of discussions between the market. There are experts who see it as a tool that, as in developed countries, determines the main vectors of macroeconomic regulation, allows you to set priorities in managing the state's economy. Is it so? Is the role of the Central Bank's key rate prescribed by experts so great? Perhaps this is a completely useless figure used by the authorities only to justify their actions?

The Central Bank's key rate - what is it?

Key rates are the values \u200b\u200bthat the main financial institutions (most often state central banks) of countries determine for loans (deposits) issued to private banks. They have a certain period of validity. This financial instrument allows you to directly influence inflation, as well as the trading of the national currency.

If, for example, the key rate of the Central Bank of the Russian Federation rises, then, according to some economists, the ruble may rise in price against the dollar and the euro, accompanied by a decrease in inflation.

Differences from the refinancing rate

In the fall of 2013, many analysts noted an innovation in the policy of the Central Bank of Russia: the refinancing rate ceased to be the main indicator of the strategy of this financial institution. The Central Bank has determined that the most important indicator for the economy is the so-called key rate. According to it, the Central Bank provides liquidity for a week. The refinancing rate and the key rate are not the same thing, but the first one has not been completely canceled by the Central Bank - it will continue to be used until 2016.

By that time, its value will align with the indicator for the second. Analysts of some banks believe that such a policy of the Central Bank is quite natural: weekly repo auctions are the most popular in the country's financial system, and it is the key rates that can help determine the actual price of the money that the Central Bank throws into the market. While the refinancing rate, analysts believe, was mostly indicative.

Taylor's rule in the Russian economy

Key rates constitute a complex model of economic indicators that operates according to the so-called Taylor rule. Most of the Central Banks of foreign countries are guided by it, forming interest rates. There are three main indicators in Taylor's formula: inflation, economic growth, and as such rates. It is easy enough to calculate the optimal value of each of them, knowing the other two. For example, for the fall of 2013, the value of the key rate of 5.6-6.3% would be fair, based on GDP indicators and the level It turns out that Russian bankers are approaching Western standards of understanding the laws of economics.

Rates in Europe

Key rates, as noted above, are used in most banking systems in the world, including in Europe. Their current value is much lower than in Russia - now the ECB operates with values \u200b\u200bof less than 1%. Regulation by the European Central Bank is intended to improve the current state of the economies of the states of this part of the world. The ECB is called upon to make decisions on assistance to credit and financial institutions in Europe and the EU in particular.

Experts note that in some cases it is possible to approve negative rates - this can have a positive effect on lending. Banks, having access to cheap loans, will be able, in turn, to facilitate the receipt of money from national borrowers - citizens, organizations, which ultimately will help reduce unemployment and stimulate economic growth. In list negative consequences the introduction of negative rates, the following is noted: there is a possibility that the real profitability of citizens may decrease.

Key rate in Russia

The key rate of the Central Bank of the Russian Federation, as well as in Europe, is one of the instruments of influence on the national economy. The practice of banking regulation in Russia knows cases when its importance increased by several tenths of a point at once. For example, at the end of April 2014, the Board of Directors of the Central Bank of the Russian Federation decided to increase the key rate from 7% to 7.5%. The Central Bank motivated this step by the fact that inflation expectations had changed. If a few months earlier its target level was about 5% by the end of 2014, then at the time the key rate was adjusted, the Central Bank's expectations became somewhat more pessimistic.

The Central Bank named several factors for changing its forecasts: the dynamics of the ruble exchange rate, as well as unfavorable conditions in the foreign trade arena for some groups of goods. Analysts note that the Central Bank practices the so-called concessional refinancing, when loans are issued by financial institutions at a rate lower than the key interest rate of the Central Bank of the Russian Federation.

Arguments for cutting the key rate

Opinions in the expert community regarding the policy of the Central Bank of Russia regarding key rates are divided. There are supporters of the thesis about the need to lower the values \u200b\u200bof this regulatory financial instrument. Their main reasoning is based on the fact that the risks of a slowdown in the country's economic growth are much higher than those associated with inflation. Therefore, when the key rate of the Bank of Russia rises, it can negatively affect the dynamics of GDP. Moreover, experts believe that there are significant conditions for reducing its value. First of all, analysts say, if inflation exceeds the expected values, it will not be much - we can expect that by the end of the year it will be 6-6.5%. These are, in historical retrospect, figures that are completely normal for the Russian economy. Some players in the political arena propose to approach the interaction between the government and the Central Bank radically: through a special kind of bills. Recently, such a project was submitted to the State Duma, and according to it, a prescription is put forward to the Central Bank: the key rate cannot be higher than 1%. According to the initiators of this bill, the current values \u200b\u200bdo not allow organizations to take out affordable loans, as is the case in many developed countries.

Arguments for raising the key rate

There are representatives of the opposite point of view in the expert environment - they believe that the key point should be increased. In their opinion, do not expect positive effect on the availability of loans, since low interest would be in reality only available large companies... Medium and small businesses could best case expect values \u200b\u200bof 6-8%. This state of affairs, experts believe, is due to the risks that small-scale organizations bear. In addition, analysts emphasize, for the Central Bank, the key rate is an instrument of influencing inflation, and a decrease in it may mean the release of prices, their out of control.

Forecasts for the key rate of the Central Bank of the Russian Federation

Many economists believe that the Central Bank of Russia will nevertheless lower the key rate. It is likely that this trend will become noticeable in the second half of 2014 - unless, of course, there are sudden problems in the economy. The authorities expect that inflation will slow down somewhat (and this factor is one of the main in the process of determining the key rate by the Central Bank), the ruble will stabilize, and the demand for deposits in the national currency will increase. Also, importantly, a good grain harvest is expected.

Therefore, experts believe that the current policy of the Central Bank is more stringent than objectively required by the market. Some analysts believe that the Central Bank's statements that rates should be raised may only be an attempt to contain inflation by rumors. In reality, the Central Bank has no reason to expect an increase in prices, but on the contrary, they will be corrected downward. In this regard, experts-optimists believe that the key rate for 2014 will not undergo significant fluctuations upward: it is much more likely that the Central Bank of Russia will choose to lower it.

Political factor

Some analysts from the banking sector note that the actions of the Central Bank may be influenced by the factor of Russia's relationship with other states. In the event of an unfavorable situation in the foreign policy arena, the ruble may weaken, and capital will be withdrawn from the country. Inflation will rise. But if relative stability remains in international relations (one of the main criteria of which will be Russia's non-interference in Ukraine's affairs), then there is every reason to expect that the Central Bank's key rate will remain at its current values.

Analysts believe that this should be facilitated by what they believe has become a traditional slowdown in the summer months. They expect that the Central Bank, seeing that prices are not growing, will not make sharp movements in terms of regulating the key rate. At the same time, supporters of this point of view emphasize that the Central Bank still needs to lower the rate at least to the level of 5.5%. Albeit in the long run.

Central bank key rate

Key rate in Russia: what an investor needs to know

When analyzing the exchange and foreign exchange market, an investor often comes across concepts such as the "key rate" or "refinancing rate". By itself, the question is very broad and requires an understanding of the basic concepts in economics that should be taken into account by a private investor when planning a portfolio and their behavior in the market. In this article I will cover:

- How interest rates of foreign financial regulators developed in the past and are now regulated;

- What is the difference between the refinancing rate and the key rate of the Central Bank of Russia;

- What factors affect the monetary policy of the Central Bank of the Russian Federation;

- What should the investor take into account when regulating the Central Bank rate?

Impact of the rate of global financial regulators

The rate of the Central Banks has always served as the most important instrument of influence of the financial authorities on the economic situation. As for the regulators of the largest countries, the size of their key rate has such an impact on the global financial market as a whole that it is difficult to overestimate it. The most influential regulators in this sense: the US Federal Reserve System (FRS), European Central Bank (ECB), Bank of England, Bank of Japan. Any investor knows the intensity of discussions among financial analysts as the next Fed meeting approaches (the last took place on March 15, 2017). Although the main reason for making a decision is only the number of applications for unemployment benefits, the volume of cheap liquidity, as well as the total face value of American debt securities, is so great that expectations (not even the decision itself) on the FRS rate can turn the world financial markets into one or another side.

Central banks also resort to changing the key rate in crisis situations when huge financial holes of banks and corporations are “flooded” with cheap liquidity. This is what the US Federal Reserve and the Bank of England did in 2008-2009, and the Bank of Japan in the early 1990s. The ECB is still forced to continue its policy of abnormally low (in some cases negative) interest rates for.

Key rate and refinancing rate: what are the differences

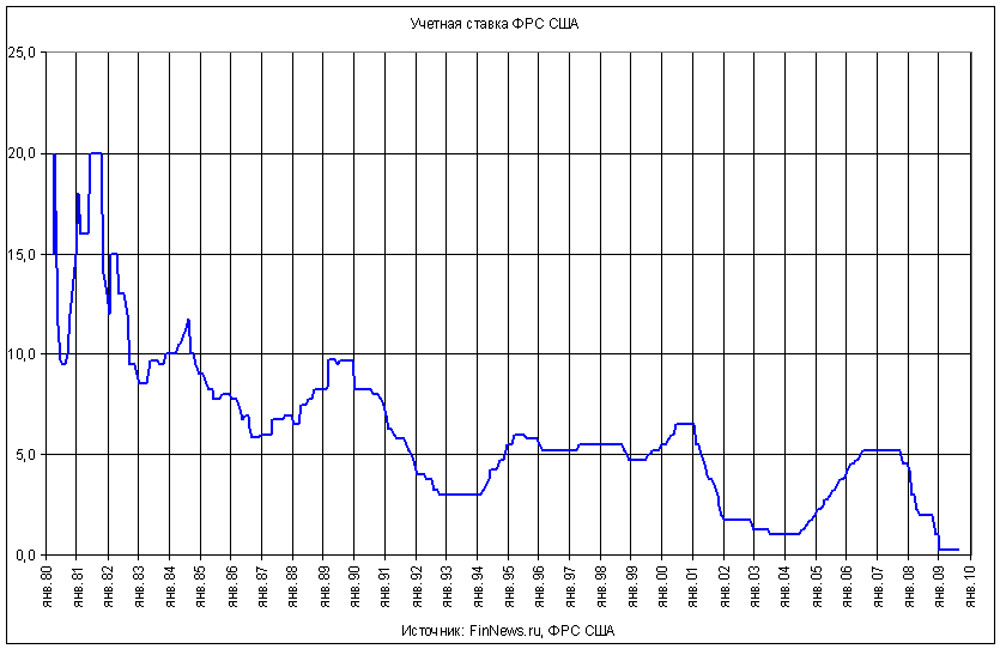

But back to the Russian market, and first, let's figure out what the historical difference between the two types of Central Bank rates in Russia was. The refinancing rate dates back to 1992, when the Central Bank first established the so-called discount rate, at which the marginal cost of liquidity provided to commercial banks in annual terms was calculated. It was later called the refinancing rate. This instrument acquired particular importance during the 1998 crisis, when the Central Bank of the Russian Federation actively used rate hikes to create benchmarks for the cost of government. This increased their investment attractiveness and reduced the colossal pressure on the foreign exchange market, when the dollar rate grew two and a half times over several months. The refinancing rate has also traditionally served to determine the size of personal income tax on bank deposits, fines and penalties, and was taken into account for calculating corporate income tax. The dynamics of the refinancing rate can be presented in the form of a graph and a table.

| Validity | Rate value |

| 01.01.1992 — 09.04.1992 | 20% |

| 30.03.1993 — 01.06.1993 | 100% |

| 15.10.1993 — 28.04.1994 | 210% |

| 06.11.1997 — 10.11.1997 | 21% |

| 27.05.1998 — 28.06.1998 | 150% |

| 19.06.2007 — 03.02.2008 | 10% |

| 14.09.2012 — 31.12.2015 | 8.25% |

| 01.01.2016 | Equated to key |

As you can see, the sample data in the table perfectly illustrate the state of the country's economy and the reaction to dramatic events on the part of the Central Bank, in the form of tightening monetary policy. The rate change resembles a swing and directly correlates with the inflation rate, the cost of loans, the dollar exchange rate, capital outflow / inflow, the financial health of real business and the investment climate.

Switching to key rate

In the process of improving the mechanisms for influencing the liquidity market, in September 2013 the Central Bank introduced the concept of a key rate, and from January 1, 2016 it equated the value of the refinancing rate to it. This is how a more flexible monetary policy instrument appeared, which allows to adequately target inflation, which is the main function of the Central Bank.

The key rate is defined as the median cost of providing or withdrawing liquidity by the Central Bank at REPO auctions ( from EnglishRepurchaseagreement, a sale / purchase transaction with an obligation to resell / repurchase), with a horizon of up to seven days. The corridor of this median can be no more than two percentage points.

The subject of sale and purchase at the auction is securities with an obligation to resell (buy) at the price specified in the repo agreement. Thus, the REPO transaction acts as an indirect mechanism of short-term loans against bills of exchange, depositary receipts. Such an instrument reduces the risks of the Central Bank, since at the time the loan is granted, the securities become the property of the lender. At the same time, REPO transactions bring good income to the Central Bank due to the difference in the purchase and sale prices. Determining the volume of money supply in such a market way, the Central Bank influences several economic parameters at once:

- Bank liquidity level;

- The volume of money supply in the country's economy;

- Inflation rate;

- Economic growth rates.

Decrease or hold?

The key rate, like the refinancing rate, affects the interest rates of bank lending. It is not surprising that the Ministry of Economic Development, which is interested not in controlling inflation, but in indicators of economic growth, traditionally acts as an antagonist of the Central Bank. The department usually actively lobbies for a reduction in the key rate, citing the needs of the real sector of the economy in available loans... Outwardly, this argument looks fair: who will object to the successful development of domestic business?

However, from the point of view of maintaining a balance in the foreign exchange market, the key rate cut should be extremely balanced and cautious. In addition, the rise in inflation, which will be stimulated by cheap money, will devalue the achievements of economic growth, and it is unlikely that Russians in the pre-election year will be happy about the sharp rise in prices for goods in stores. I would say that at the moment the Central Bank is successfully defending its position and pursuing a conservative monetary policy. The smooth decrease in the key rate in March 2017 from 10% to 9.75% only confirms this.

It is important to understand that the Central Bank rate does not determine 100% the cost of lending. In this indicator, other factors have no less weight. This is a shortage of "quality" borrowers and non-repayment of borrowed funds, as well as administrative costs associated with the introduction of increased capital adequacy ratios and other regulatory measures. Therefore, a decrease in the key rate, bearing in itself the risks of a sharp rise in the dollar exchange rate and acceleration of inflation, will not necessarily lead to the desired reduction in the cost of loans for business and the population.

Let me give you an example. If a regular loan for a small business costs 22% per annum, then a decrease in the key rate to 6% (as some economists suggest) does not mean automatic lowering loan rates up to 18%. The prime cost includes mandatory reserves for delays, administrative costs for its collection, the cost of personnel, which will rise in price due to inflation and other costs. At the same time, the net banking margin rarely exceeds 3%. I suggest looking at the chart for an illustration of how the key rate and the dollar rate are interconnected.

Carry Trade in Russia

There is another important aspect to the impact of the key rate on the economy. I'm talking about the attractiveness of the Russian financial market for foreign investment funds. They have hundreds of billions of dollars on their balance sheets and choose a profitable investment in countries with high bank rates for their portfolio. Such operations are called Carry Trade ( literally - to trade) and are based on a significant difference between the low interest rate of borrowed funds to fund investments and the rate in the market of the country where investments are made.

So, in the markets of the European Union, Japan and Switzerland, the cost of borrowing is close to zero. The choice of investors is usually made between countries such as Brazil, Argentina, Turkey, Egypt, South Africa. Russia is on the same list, since the difference with interest rates, for example, in the United States is about 8%. In this case, we do not consider China as an object of such investments, since there are huge direct (not portfolio) investments in the manufacturing sector, and the Halyk Bank rate is not interesting for speculators: it varies from 1.5% on deposits to 4% on loans.

Portfolio investors who come to russian market for the sake of speculation on Carry Trade, they cannot be considered as reliable and long-term financial partners. Russian economic history knows many examples when tens of billions of dollars left the country almost at once, with a decline in profitability, which no longer compensates. This is the danger for the profit of a private investor who has made a long-term bet on ruble assets and not enough of his risks.

Conclusion

For an ordinary private investor, information on the dynamics of the Central Bank's key rate, in addition to the general news background, is of direct practical importance. The simplest examples are the growth in bond yields (including) as the rate decreases, as well as the inevitable consequences of the change in the Central Bank rate for the foreign exchange market, where the rate cut provokes demand for dollar liquidity that is more expensive relative to the ruble.

I invite all readers to take part in the survey.

date of publication: 27.12.2015

update date: 28.10.2017

Since January 01, 2016 in the Russian Federation, there are simultaneously two equal interest rates: the refinancing rate and the key rate. Usually, one rate is sufficient as a global macroeconomic indicator, but Russia often has its own, distinctive path, so we are no stranger to the peculiarities of the national economy. Let's see why it happened, why did the Central Bank of the Russian Federation introduce a key rate and, most importantly, why does Russia need two rates that are equal and similar in meaning?

First, let's define the meaning of the key rate and recall the history of its appearance. What key rate of the Bank of Russia?

The key rate is the rate in percentage per annum at which the Central Bank of the Russian Federation lends funds in rubles to commercial banks for a period of one week or receives funds from banks on deposit for one week. Not entirely clear ... is this the acquisition rate or the placement rate? It depends on the need: if banks need money, then the Central Bank of the Russian Federation is ready to provide ruble loans at the key rate, and if banks have free cash balances, then the Bank of Russia is ready to accept deposits from banks at the key rate. And there is one nuance here: the key rate is minimalinterest rate for loans provided by the Bank of Russia and maximum the interest rate at which the Central Bank of the Russian Federation is ready to attract deposits. In other words, credit institutions can take a loan from the Central Bank of the Russian Federation at a key rate or higher, but they can put money on a deposit with the Central Bank of the Russian Federation at a key rate or lower.

Key rate was introduced on September 16, 2013. Since then, both the key rate and the refinancing rate have been operating simultaneously. At the same time, from September 16, 2013 to December 31, 2015, they had different values: the refinancing rate remained unchanged at 8.25% per annum, and by the Bank of Russia, changing its value due to the actual state of affairs in the economy. Since 2016, the value of the refinancing rate has been equated to the value of the key rate. The independent value of the refinancing rate is no longer set, because it automatically changes when the Central Bank changes the key rate.

Why did the Central Bank of the Russian Federation come up with a key rate? The fact is that during the period of relative stabilization of inflation and the ruble exchange rate (2010 - 2013), the refinancing rate fluctuated between 7.75 - 8.25% per annum and was the only indicative rate. And since the Russian economy was really developing well, and only positive changes were expected ahead, it seemed to many that the current refinancing rate was too high and slows down the necessary processes. The Russian government has repeatedly demanded that the Central Bank reduce interest rates on loans for commercial banks in order to stimulate economic growth, because in this case, banks will be able to lend to enterprises at a lower interest rate. This demand was constantly echoed by public opinion, supported by multiple articles in the media. It was believed that the Central Bank of the Russian Federation was to blame for the lack of sufficient economic growth, because the rates were too high. By the fall of 2013, the demand for the need to reduce the main rate in the country became too insistent. But the truth is that both before September 16, 2013, and for a long time after, the Central Bank of the Russian Federation carried out a lot of its operations to provide banks with money significantly below the refinancing rate (that is, below 7.75 - 8.25% per annum). However, the society firmly strengthened the position that supposedly the main problem of the economy lies precisely in the high refinancing rate, at which loans were not provided to banks at that time (it just happened) and which simply reflected the inflationary processes in Russia, being an indicator of a certain fair interest rate for tax, customs and other needs.

The Central Bank of the Russian Federation, realizing some absurdity of the situation and experiencing pressure from all sides, was looking for an accurate, delicate solution to the problem. And he found this solution! The Bank of Russia introduced a key rate and announced that loans are provided to banks precisely at the key rate, which at that time was 5.5% per annum. An ingenious solution and at the same time a clever trick: the Central Bank of the Russian Federation kept the refinancing rate and announced to everyone that lending to banks is carried out at the key rate. The Central Bank withdrew the claims against it, leaving essentially everything as it was.

The Central Bank of the Russian Federation, realizing some absurdity of the situation and experiencing pressure from all sides, was looking for an accurate, delicate solution to the problem. And he found this solution! The Bank of Russia introduced a key rate and announced that loans are provided to banks precisely at the key rate, which at that time was 5.5% per annum. An ingenious solution and at the same time a clever trick: the Central Bank of the Russian Federation kept the refinancing rate and announced to everyone that lending to banks is carried out at the key rate. The Central Bank withdrew the claims against it, leaving essentially everything as it was.

Agility of mind and no fraud.

Explaining the innovations, the Bank of Russia in 2013 drew attention to the fact that, by tradition, the main rate of central banks is considered the refinancing rate. Deliberately reducing the importance of the refinancing rate and putting the key rate in the main role, the Central Bank of the Russian Federation promised that it wants to keep the brand called "", so by 2016 the refinancing rate will become equal to the key rate. Then, in 2013, the impression was that the regulator would abandon the artificially introduced key rate as a temporary measure, and the role of the refinancing rate would completely return to it. But, as you know, there is nothing more permanent than temporary. The reason for this is a whole string of circumstances that no one could have guessed about in 2013: the annexation of Crimea, sanctions, restriction of access to external borrowing, renewal of 11-year lows in oil prices, military operations in Syria, Turkey-shot down Su-24, import substitution, dollar by 70 rubles ... In a word, a whole kaleidoscope of events in which the size of the key rate soared up to 17% per annum, allowing the country to more or less adequately respond to economic challenges.

So, today in Russia there are formally different, but the same rates. One of them is assigned the role of the main rate at which liquidity is provided and absorbed. The second is the role base rate for various subsidies, monetary compensations, tax calculations, including for calculating interest in case of deferral or installment payment of taxes, calculating penalties, etc. (all this is provided for by various federal laws). Let's think ... the very fact that there are two equal bets with different names is a reason to use them again, including an excuse to set different values \u200b\u200bfor them or to implement another clever move. No full confidence, but there is a feeling that two rates are left in the economy just in case.

History of changes in the key rate of the Bank of Russia

|

Validity |

Key rate |

For comparison: |

|

8.25% per annum (present value) |

the value corresponds to the key rate of the Bank of Russia and changes automatically when the key rate changes |

|

|

from 18.09.2017 to 29.10.2017 |

8.50% per annum |

|

|

from 19.06.2017 to 17.09.2017 |

9.00% per annum |

|

|

from 02.05.2017 to 18.06.2017 |

9.25% per annum |

|

|

from 27.03.2017 to 01.05.2017 |

9.75% per annum |

|

|

from 19.09.2016 to 26.03.2017 |

10.0% per annum |

|

|

from 14.06.2016 to 18.09.2016 |

10.5% per annum |

|

|

from 01.01.2016 to 13.06.2016 |

11.0% per annum |

|

|

from 03.08.2015 to 31.12.2015 |

11.0% per annum |

8.25% per annum |

|

from 16.06.2015 to 02.08.2015 |

11.5% per annum |

|

|

from 05.05.2015 to 15.06.2015 |

12.5% \u200b\u200bper annum |

|

|

from 16.03.2015 to 04.05.2015 |

14.0% per annum |

|

|

from 02.02.2015 to 15.03.2015 |

15.0% per annum |

|

|

from 16.12.2014 to 01.02.2015 |

17.0% per annum (max value) |

|

|

from 12.12.2014 to 15.12.2014 |

10.5% per annum |

|

|

from 05.11.2014 to 11.12.2014 |

9.5% per annum |

|

|

from 28.07.2014 to 04.11.2014 |

8.0% per annum |

|

|

from 28.04.2014 to 27.07.2014 |

7.5% per annum |

|

|

from 11:00 Moscow time 03.03.2014 to 27.04.2014 |

7.0% per annum |

|

|

from 16.09.2013 to 11:00 Moscow time 03.03.2014 |

5.5% per annum (min.value) |