Alor Broker is a trading agency specializing in all branches of brokerage. The company is one of the pioneers of online trading, a niche leader that has been in the industry for over 15 years. At the moment, several large branches are deployed in the regions.

Alor Broker offers not only ready-made solutions, but also conducts training courses and webinars on the basics of trading skills. The company will provide package products, as well as help to open an individual investment account for a private person.

For major market players, the brokerage firm provides advisory services on portfolio management. More detailed information on the activities of the organization and the functionality of the platform can be found on the website and using personal Area Alor Broker.

Personal account features

Alor Broker's personal account provides the user with opportunities for the following operations:

- View brokerage reports for the period of interest.

- Connecting and configuring products and services.

- Submission of orders for non-trading operations with securities and money.

- Ordering certificates and extracts, including 2-NDFL.

- Broker consultation.

- Online registration for training events.

Registration and login to your personal account

To register, you need to click the "Become a client" button on the main page of the resource. In the field that appears, you need to enter such data as: name, contact phone number, city, e-mail address and promotional code, if any. After filling out the form, the call center operator contacts the future client and explains step by step further manipulations to create an account.

Professional Participant Notes: Broker vs Client (how to make money on a client)

... brokers from clientswhat services are and how reality differs from what is presented client .... Let's figure it out: What makes money broker?! On the commission - i.e. active operations and on ... clients- "marginals" under 10-14 per annum. The main task broker - to client actively traded: Client ...

Analytics Read ...Pro Market: Current State. Brokers and clients.

....; Renaissance (5th) - 83.6 billion. Now let's talk about clients brokers... We take 2006 as the point "zero" ... they understand that the main income is clientsand brokers (if we talk about commission + margin ... -101 thousand; Sberbank - 191-167 thousand. Clients began to change brokers... And the latter are quite concerned about ...

Analytics Read ...Alor broker also lost confidence, crashing yesterday

Only I was glad that I switched to alor broker and alortrade. But not even 3x ... and nerves have passed. Unfortunately, I do not know normal brokers, on it and finam too full ...

Analytics Read ...Broker verification: a way to delay the payment of profits or protect clients' investments ?!

By verification clients often become a manipulative tool in the hands of an unscrupulous brokerwhich allows ... the account does not involve two parties: broker and client, but three: between them is always ... a receipt for the rent. Therefore conscientious broker proposes clients alternative - bank statement ...

All about binary options Read ...Almost all brokers use client funds

Protection of funds clients brokerage companies. The regulator intends to oblige brokers guarantee clients their return ..., the new requirement will equalize the situation client and broker... "When broker credits client, it requires security. We...

Analytics Read ...Brokers and clients: NAUFOR statistics

Placed 7 billion rubles. Number of new clients for the opening of the IIS was 55 .... rub. The total amount of funds transferred brokers and manager \u003d 420 billion rubles. Total ... thousand rubles where money is deposited clients? 32% - shares of Russian issuers 19 ...

Analytics Read ...Forex4yu - a broker with favorable conditions

To accounts clients. Broker is engaged in licensed professional investment activities. Offices broker located in ... clients, desire to improve services and go forward. Benefits broker Forex4yu Broker provides asset segregation clients ...

Unga | Review date 2017-06-16

I am satisfied with the broker, I can also leave a good review about Alor. I transferred and withdrawn money more than once, with amounts in the range of 500-800 dollars without any problems. But there are downsides here. With a strong market movement, the terminal freezes, all this was far from once, for the time being it did not affect my trading, but once I suffered, since I could not close a profitable position, and it very quickly went into negative territory. Therefore, I carefully monitor the calendar of forex events, or immediately set take profit. On the plus side, I can say that orders are triggered instantly and requotes are rare.

The author of the review about (about) Alor Broker: Stas | Review date 2017-06-14

I wanted to open a trading account with a broker, but as soon as they found out my phone number and e-mail, they just bombarded with spam and various offers, some kind of promotions and bonuses. Such intrusive service only scares me away.

The author of the review about (about) Alor Broker: Leonid | Review date 2017-06-05

The author of the review about (about) Alor Broker: dmitrenko | Review date 2017-05-22

The withdrawal of 4000 re has been hanging since last Monday. Of course, I understand that this is a bank transfer, but a week for withdrawal is already too much. Worst of all, the support remains silent, all they say is "expect" and how much is unknown. I wrote a claim to the financial department, I'm waiting for an answer, what else remains. But the broker's impression has already been spoiled.

The author of the review about (about) Alor Broker: Tornton | Review date 2017-03-07

And for me everything is good here. Not the strongest broker, but you can make some money if you want. On the demo, everything worked out, translated to real. And they have training. If I get in, I always try to watch. sometimes reveal secret things)

The author of the review about (about) Alor Broker: Athos | Review date 2017-01-13

It turned out to be even more unprofitable to trade on the ruble account than on the dollar one. In the first week of trading this year, I lost $ 56. The spreads are even tighter here. And I do not recommend investing in trust management, which I have dabbled in before, I have never heard of anyone helping to make money. All accounts were leaked sooner or later. And mine too.

The author of the review about (about) Alor Broker: A rock | Review date 2016-12-08

The depot is not frail, the spreads are small. I'm so happy, let's pips this and that. And the profit was not bad. Then he got burned at the conclusion. There is also a commission on each conclusion. Moreover, according to the results, they took 3% more from me than they stated under the conditions. It is a pity, since it would be easier to work with a large spread, it is more profitable if you spend so much on withdrawal. As a result, everything with the depot together in the amount of 24 thousand rubles. took out 3 weeks. Be ready.

The author of the review about (about) Alor Broker: Zurab | Review date 2016-11-02

I liked the broker right away, they work well - the execution is excellent, if you have any questions, the support helps (it works 24/7), the terminal is without bugs, and the software is updated only on weekends. Of the advantages for beginners - there is training and client management, you can do both in training centerand through webinars, everything is free. Especially interesting classes are taught by Konstantin Yakovenko, a special thanks to him from me!

The author of the review about (about) Alor Broker: senator | Review date 2016-09-28

For once, I decided to try to trade with a domestic broker. As a result, I closed the account after 3 weeks. And then I already managed to drain 2000. And all because of the constant slippage, the platform is very weak here. Either the deal will close from the 5th time, then the stop will not work, an extremely unstable system. The support is inactive. The remains of the depot were taken out for a week.

The author of the review about (about) Alor Broker: Sergei | Review date 2016-09-16

Terrible company There is no worse than sharaga in Arkhangelsk !!! At first, their stop losses did not work in 2016 the new kind activities commission theft Take a commission 3 times a month for 350 rubles !!! At seminars, baby talk is not anything sensible !! I do not advise

© 1997 - 2017. Brokerage company "ALOR BROKER"

Unauthorized copying, distribution, as well as publication of site materials for any purpose is prohibited.

Brokerage services are provided by ALOR + LLC on the basis of License No. 077-04827-100000 dated March 13, 2001, issued by the Federal Service for Financial Markets for an unlimited period of time.

Custody services are provided by ALOR + LLC on the basis of License No. 077-10965-000100 dated January 22, 2008, issued by the Federal Service for Financial Markets for an unlimited period of time.

The information presented on this website is for informational purposes only, is not and should not be considered as an offer or advice on the purchase or sale of securities / contracts / currency, other investment products offered by ALOR + LLC (hereinafter referred to as the Company). Information about rates of return, the results of investment decisions are indicative, presented solely for clarity and should not be considered as guarantees or promises in the future of performance (return on investment). The results of the client's investment decisions depend on many factors, including the amount of investment, the chosen tariff plan, and the current market situation. Transactions such as "short" are associated with additional risks of changes in the price of a financial instrument, which may lead to loss of funds.

By general ruleunless otherwise provided by law Russian Federation or by an agreement with a client, transactions and other operations with securities / contracts / currency, other investment products offered by the Company are carried out by the Company on the basis and in accordance with the terms of the orders submitted by the client.

When submitting instructions, the client should independently assess the feasibility, economic feasibility, legal and other consequences, risks and benefits of a transaction or other operation with securities / contracts / currency, other investment products offered by the Company, making decisions solely by his own will and in his own interest, in including having previously studied the terms of the contracts concluded with the Company and having read the warning about the risks associated with conducting operations on the securities market and the derivatives market (Appendix 5 to the Company Brokerage Regulations).

For any questions that arise, as well as if you need to obtain additional information please contact the Company's employees at the above telephone numbers and addresses.

* - ALOR BROKER is among the top ten “Leading operators. Shares: T + main trading mode, negotiated deals mode and negotiated deals mode with CCP "and" Stock market leaders in the futures and options section by the volume of transactions "according to the Moscow Exchange rating for September 2016.

Investor Diary: "Think and Grow Rich"

Capitalist

Greetings! I continue my series of posts about Russian brokers. Today my "hero": ALOR Broker reviews, history, services, rates and personal opinion. In general, as always. 🙂

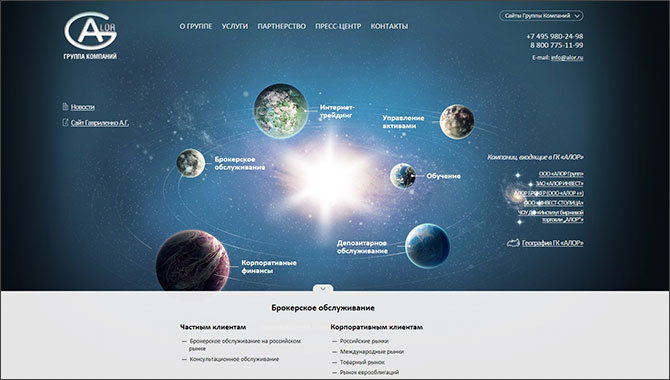

LLC "ALOR +" is a part of the group of companies ALOR, working on russian market since 1993. All companies in the GC are professional participants in the securities market with appropriate licenses. The ALOR group includes: ALOR INVEST, ALOR BROKER (or ALOR +), INVEST-STOLITSA and ALOR BANK.

The ALOR + company became one of the first Russian brokers (officially operating on the market since 1997), providing professional services in the field of Internet trading. It is included in the TOP-10 brokers of the derivatives and stock markets. Has all licenses for brokerage, depository and dealer activities.

By the way, "ALOR +" was one of the first in Russia to offer its clients to trade securities via the Internet.

The central office of the company is located in Moscow, regional - in St. Petersburg, Kursk, Murmansk, Tyumen, Yaroslavl, Samara, Ufa, Irkutsk, Kazan and other cities of Russia (50 offices of "ALOR +" are open in 60 cities). The broker employs thousands of employees and more than 30,000 clients (as of August 2015).

Duties general director LLC "ALOR +" in 2016 performed by A.G. Saribekov. The company is accredited on all of the largest stock exchanges in Russia: the stock and derivatives sections of the MICEX, the FORTS (RTS) derivatives market and many others.

By the way, according to the results of 2006, 2007 and 2008. "ALOR +" was included in the TOP-5 brokers! Today he has already lost his position and judging by the site (which seems to have also been updated at the beginning of the 2000s!) Does not really want them back. What is the "Tariffs" section alone, where I spent 15 minutes trying to figure out what's what ...

Available markets and instruments

On the stock market, the broker provides access to the MICEX and the St. Petersburg Stock Exchange. In the derivatives market, ALOR clients can trade on the Moscow Exchange, Mosenergobirzh and SPIMEX (derivatives market section). To buy and sell foreign currency, the broker opens access to the Moscow Exchange.

Through "ALOR +" you can trade Russian and foreign issuers, and shares, Eurobonds and, currencies,.

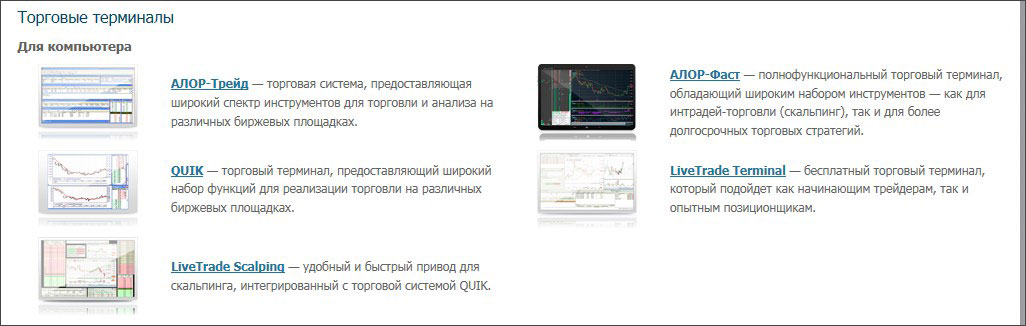

For trading, the ALOR + broker offers the following terminals: ALOR-Trade, ALOR-Fast, QUIK, LiveTrade Terminal and their mobile versions.

By the way, the "ALOR-Trade" program - own development company established back in 1999. And the program "ALOR-Fast" contains a sea of \u200b\u200bauxiliary functions and significantly increases the speed of placing and withdrawing applications.

The minimum deposit for clients in "ALOR +" is 10,000 rubles.

Tariff policy

The rates of the "ALOR +" broker depend on the type of market in which you are going to trade and, frankly, they are expensive. Moreover, the site contains not full versions tariffs, and in order to deal with them in detail, you will have to download a pdf-document of 45 sheets to your computer!

Stock market

For the first acquaintance with a broker, the "Welcome!" Tariff plan is ideal. Depending on the turnover per trading day, the commission for the client will be 0.017 - 0.08%. The tariff plan is valid for 30 days from the date of joining the regulations. As a bonus, the broker provides the "ALOR-Strategy" program and the "Investment Advisor" service free of charge.

Those who have been on the market for less than one year can choose the "First" tariff plan. Depending on the daily trading volume, the broker's commission will be from 0.03% to 0.05%.

For traders actively trading with leverage, the Active tariff plan is suitable. The commission will be 0.01-0.08%. Experienced investors choose the "Professional" tariff (0.025-0.04%).

For those who use the ready-made strategy "ALOR-Robot", the broker offers the tariff plan " Stock market... Percentage "(with a commission of 0.05% of the amount of transactions) or the tariff" In half "(250 rubles per month)

And finally, the “Consultant” tariff plan is useful for those who use the “Consulting service” service (the broker's remuneration is 0.06%).

For the derivatives and foreign exchange markets, the broker offers its commission at the exchange level (1 rubles per transaction) plus 200 rubles. per month for maintaining the account. Expensive!

Additional services

ALOR-Robot

ALOR-Robot is a program for making transactions in automatic mode according to a pre-selected strategy. Allows you to trade on the market without the personal intervention of the trader. Minimizes the influence of the human factor (in other words, eliminates the mistakes of the broker's employees).

At its core, it is by which. The best of the ones presented on the broker's website showed + 25% since the beginning of 2016.

Consulting service

The service is suitable for those who entrust the management of their own funds to professionals and do not want to personally participate in trading.

An ALOR consultant will develop an individual investment strategy, propose investment ideas and draw up a portfolio for them. The consultant's responsibilities also include regular portfolio adjustments (the purchase and sale of assets is carried out only with the consent of the client).

Basically, "Consulting" is almost passive investing (along with a bank deposit or real estate purchase). True, investing with a higher rate of return (high risk) and for a longer term.

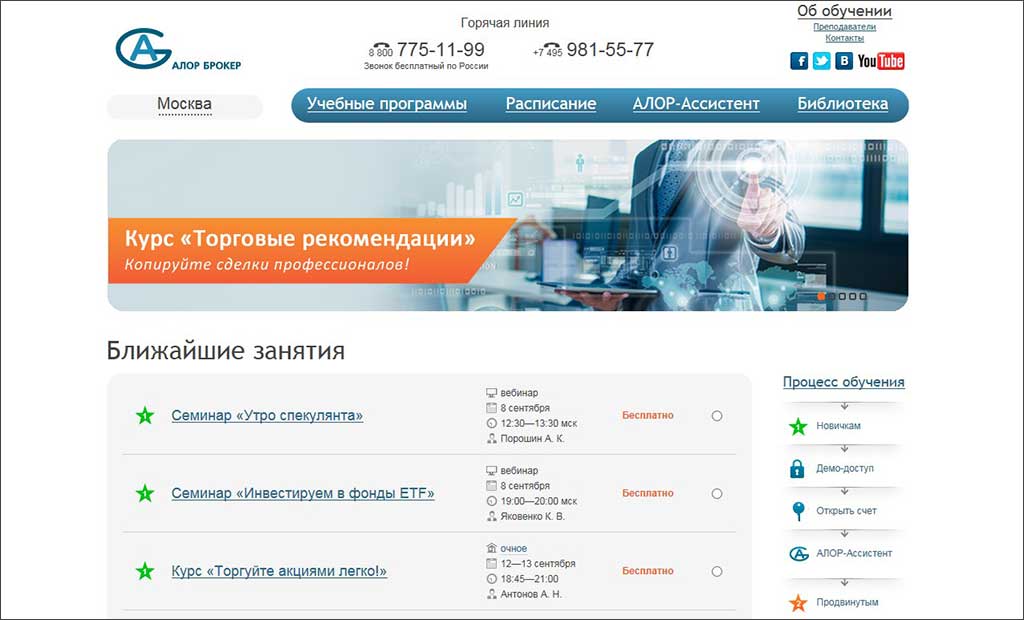

Training

ALOR Broker provides training in trading for different audience levels in two formats: full-time and part-time. These are courses, seminars, "Traders' Club", individual training, a large library and a system of remote complex support ALOR-Assistant.

Investment

With the help of "ALOR Broker" you can not only trade, but also passively invest. Passive investment options:

Structured products: "Protective", "Profitable" and "For shareholders".

The minimum investment in structured products starts from 300,000 rubles for a period of two weeks to six months. The level of risk depends on the type of product. For example, the structured product "Protective" (version "Stable income") allows you to earn more than on a bank deposit, and protect yourself from. Provides a fixed rate of return that does not depend on the market situation.

Package products: "Portfolio from funds" (from 20,000 rubles), "Portfolio from bonds" (from 100,000 rubles) and "Currency" (from 150,000 rubles).

“Portfolio of funds” distributes savings among various exchange-traded funds (). "Bond portfolio" invests money in fixed income bonds (the yield is higher than on bank deposits). The Currency product invests funds in Eurobonds with interest income in US dollars.

Pros and cons of a broker

- Poor customer support

- Hanging Quick

- "None" by modern standards site

- One of the highest commissions on the derivatives market

Personal opinion

"ALOR +" today is a good and reliable Russian broker, which, in addition to direct access to the stock, derivatives and foreign exchange markets, offers clients a lot of convenient services and options. However, you have to pay for this in every sense of the word - out of pocket for expensive commissions and nerves for the braking Quik terminal. To be honest, there are much more interesting options for the derivatives market -, or.

What do you think about the ALOR + broker? Subscribe to updates and do not forget to share the most interesting posts with your friends on social networks!