Reliability 5.0

Yield 4.0

The largest retail broker in Russia, as well as an investment group specializing in the provision of trading, investment banking services, trust management of funds and securities, investing in the Forex market. Regulated by the Central Bank of the Russian Federation.

4.5 Final assessment

Finam Investment Holding is one of the leaders in the brokerage market in Russia. The holding controls 14% of all trading on the MICEX. He also provides a wide range of services: from investing in stocks to trust management. And, of course, the company provides brokerage services in the Forex market.

If we begin to consider in detail each of the methods of investing and trading, we will not have to prepare an article, but a book. There is really a lot of information. Therefore, today we will focus only on the Forex market. Let's consider what conditions are offered to traders on the official Finam website, let's talk a little about the company itself and find out if it's worth starting trading here.

Finam broker video review

Main trading conditions

Finam is a platform for professional speculators. However, it will not be difficult for novice traders to get used to it. However, about everything in order.

- Minimum deposit - $ 100 for a standard account and 200 USD for ECN. There is only one nuance, which you will learn about later.

- Trading tools - 26 currency pairs.

- Trading platform - Meta Trader 4, web tool and mobile apps.

- Spread - from 0 points.

- Leverage - the default value is 1:50. Can be raised to 1: 500.

- Demo account Broker Finam is provided, but for a limited period.

Opening an account

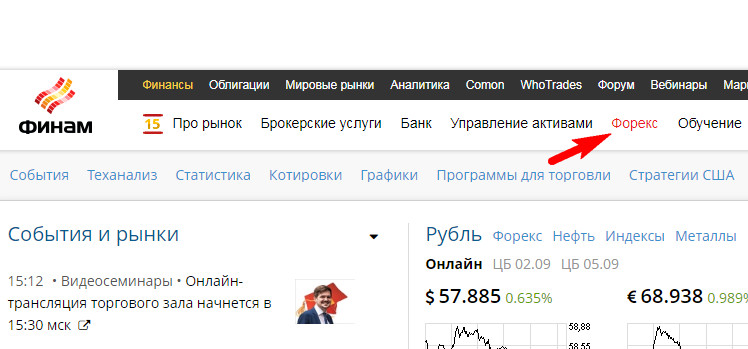

On the main page of the site, open the "Forex" section.

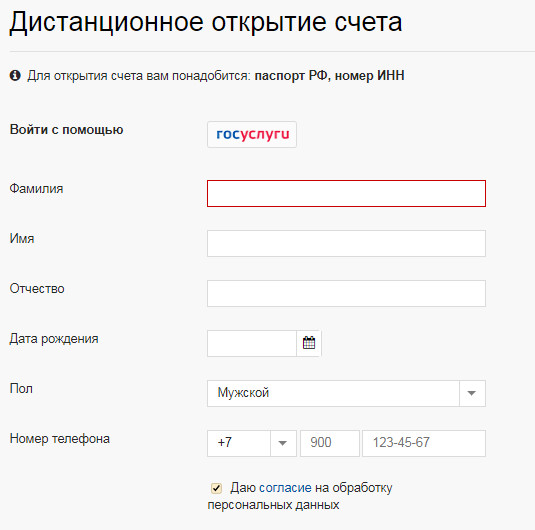

Then select "Forex Cabinet", and then open a brokerage account. To open an account remotely, you will need to enter the following contact information: last name, first name, patronymic, date of birth, phone number. Please also note that the trader will need a passport and TIN.

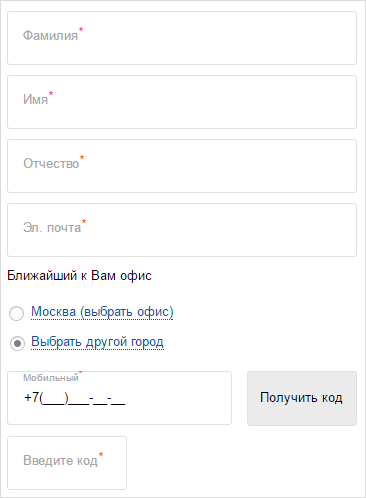

Before full registration, you can create a demo account for a virtual amount of 100,000 rubles. In this case, you can already do without a passport. You will have to indicate your full name, e-mail, phone number to which you will receive a confirmation code. After that, a letter with a login and password for entering Meta Trader 4 is sent to the mail. There is also a link for downloading the terminal.

Finam official website regulation

Broker Finam is a professional market participant valuable papers... The company was licensed by the Central Bank of Russia to operate as a forex dealer. The license has been valid since December 14, 2015. A copy of it can be viewed on the official website. Therefore, questions about reliability disappear.

Finam also received licenses from the Central Bank of the Russian Federation to carry out dealer, depository, as well as to carry out activities for the management of securities and investment funds.

Making a deposit and withdrawing funds from a Forex broker Finam

Earlier, we reviewed the Alpari broker. So, he has more than 30 ways to deposit. There is no such possibility on the Finam website. You can send a deposit only by non-cash method by transferring money from one bank account to the nominal account of the Forex broker Finam. Finam Bank customers can use Internet banking.

The crediting period largely depends on how long the sending bank will carry out the transfer. Within 1 day after the funds are credited to the company's account, they will appear on the trading account.

Withdrawal of funds from the official website of Finam is carried out only to a personal account that belongs to the trader. Withdrawal period - up to 2 working days, no commission is charged.

Registration with Just2Trade Online

The financial company Just2Trade Online Ltd is part of the Finam holding. And if on the website of the holding itself it is rather difficult for a beginner to figure out where to trade, where to look for other information, where to work with the bank, then everything is simple here. Just2trade online was created specifically for trading in the Forex market, as well as for trading on the US stock exchanges and global futures.

Let's register here. Let's start by looking at other aspects of trading.

Account types

The broker offers 2 types of accounts for trading: Standart and ECN. Each of them can also be opened in demo mode. The main difference between the accounts is that ECN allows you to go directly to liquidity providers. But there are other differences as well.

Standard:

- The minimum deposit is $ 100;

- Leverage - up to 1: 200;

- Spread - from 0.5;

- Currency pairs - more than 50;

- Brokerage commission - 0%.

- The minimum deposit is $ 200;

- Leverage - up to 1: 100;

- Spread - from 0;

- Brokerage commission - from $ 6.

Deposit / withdrawal of a deposit

Several dozen are available to top up your account payment systemsthat allow traders from different countries... Now we will list only those ways that speculators from Russia and the CIS can use (we are unlikely to be read by residents of Australia, Finland and other countries).

- Bank transfer. Replenishment currencies EUR, USD, RUB. Enrollment time 2-3 work. days;

- Bank card. Instant replenishment in euros, dollars or rubles. There is no commission;

- Promsvyazbank, Alfa-Bank for replenishment in rubles without commission;

- Qiwi (RUB) - commission 3.3%;

- WebMoney - RUB, USD, EUR no commission;

- Yandex.Money - RUB, 4% commission, etc.

ECN account with the Forex broker Finam can also be replenished using Bitcoin and Russian Post.

There are fewer ways to withdraw funds:

- Finam bank - money comes the next day without commission;

- Transfer to a bank account. The minimum commission is 12 dollars, 30 euros or 500 rubles;

- Neteller, Skrill, bank card.

Now let's sign up. On the official Finam website, select the "Forex" section, and then click the "FOREX account with 20,000 EUR insurance" button, after which you will go to another Finam website.

There you can already open a real or demo account. To do this, you only need to specify the necessary data.

This is how we started to analyze one Forex broker Finam, and ended up with another. What can we say in conclusion? The official Finam website is a place where a trader can trade in the Forex market without worrying about being put in a wheel.

In addition, besides FX, there are other opportunities for earning money (deposits, trust management, trading in other markets). And also a huge amount of information for traders: webiaars, analytics, training, forum, etc.

Good day, dear readers of the blog site! The topic of today's article is brokerage company Finam appearing on russian market among the first and has gained immense popularity among traders.

The guarantee of the company's reliability is the license of the Central Bank. The Central Bank selects brokers very harshly, so don't worry, this company can be trusted. Below we will get acquainted with the available financial instruments of Finam, terminals for trading, conditions and promotions.

Finam brokerage services

Have you read the very first article on the foreign exchange market -? If not, read it without fail, otherwise you will not delve into the key feature of Finam.

The broker in question does not specifically specialize in Forex, it offers very wide choose instruments, including securities ( stock market) and goods / raw materials (oil, sugar, gasoline, etc. - the path of the commodity market).

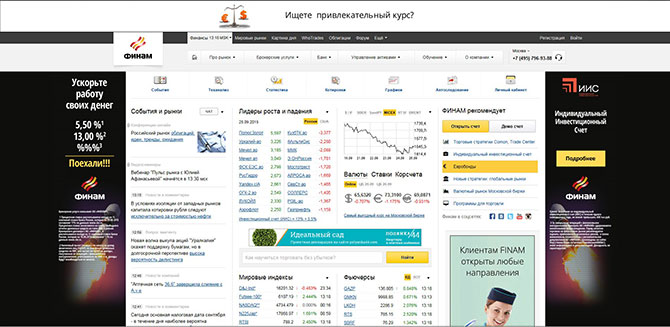

A control menu is available at the very top of the main page of Finam's official website. First of all, we should be interested in the items "Brokerage services" and "Forex".

In "Brokerage Services" the administration offers to open a common account for trading with all existing financial instruments, in "Forex" - an account of a narrower direction, where only currency pairs are presented. They differ in minimum deposits and a number of other aspects, but more on that below.

The main difference is that there is no general account, for each transaction a commission is paid depending on its volume (read the article about). Let's first consider the first option, which will allow you to easily move from one market segment to another.

One account for professional traders

A single account gives us access to the following markets:

- Stocks and bods market Russian Federation.

- The market for forward contracts of the Russian Federation (futures, forwards, options, etc.)

- The foreign exchange market of the Russian Federation (just Forex).

- US stock market.

What commission does the broker charge when making transactions? It depends on the instrument and the number of positions: the larger the amounts we use, the lower the commission fees. The table below shows data for a daily trading turnover of less than 1,000,000 rubles, for US stock market shares the value is given for a volume of less than 10,000 shares.

Dependence of the commission on the type of instrument.

The management closely monitors technical innovations and offers customers the most modern software.

Three platforms are available for making trading operations:

- Finam Trade + Mobile - you can trade via the network without installing the program on your computer. Mobile versions have been developed for all existing operating systems.

- Transaq

The MetaTrader5 platform, which we briefly described in the article, is under development. In the near future it will appear in the list of available services.

let's we will open a demo account to trade first through the Transaq platform (then we will carry out a similar operation to get acquainted with the Quik terminal), click on the appropriate button for this.

The demo account can be used for three months, no more. The registration form looks like this (passport data is not required for the training auction).

After entering the phone, a four-digit code will be sent to it. If you enter it correctly, the system will thank you for registering and send an email with all the information you need to get started (including your login and password, a link to download the terminal).

After installing the trading platform, you need to log in - enter the ID and password sent by the system to the mail. If the work is completed successfully, you can proceed to direct trading (and it is not necessary to enter your personal account, everything is done through the platform).

Transaq and Quik trading platforms

Transaq is completely different from MetaTrader, so you won't be able to open deals through it without preliminary preparation. Graphical tools, in theory, do not differ, but the interface is still different.

For example, compare the views of Transak and MetaTrader after the direct launch, obviously there are more differences than similarities.

MetaTrader.

To select a time interval, right-click on the chart, press "Periods" and specify the desired option. A total of 18 timeframes are available - twice as many as in MT4. Please note that intraday periods prevail, this is due to the fact that the stock market does not work around the clock, unlike Forex, and it is more promising to speculate "introday".

![]()

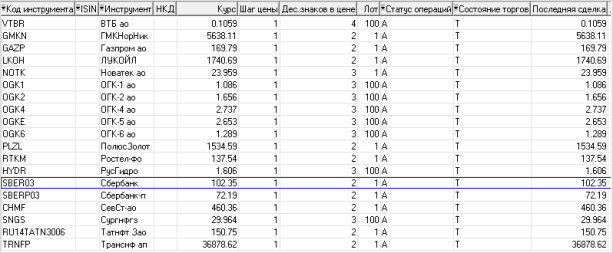

Securities (the "Master List" of Instruments ") available for trading are listed below.

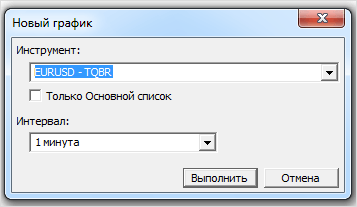

As you can see, you can trade stocks of the largest russian companies... To view full list instruments, open the required charts, first select "Charts" - "New Chart".

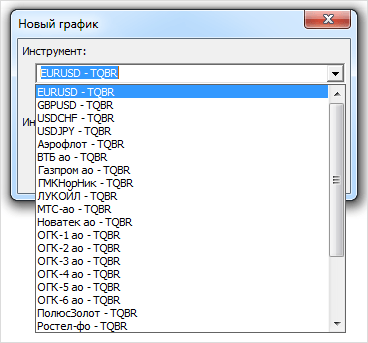

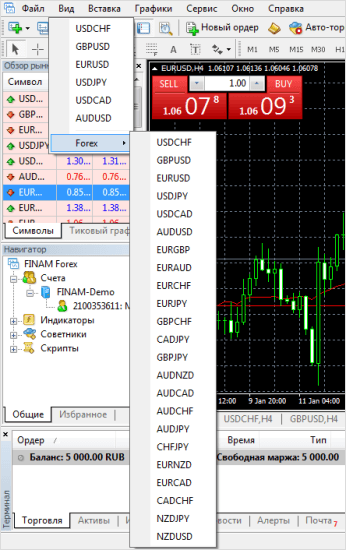

Then we indicate the desired financial instrument - the list is already more extended, there are currency pairs (although there are not as many of them as we would like).

New positions here are called not orders, but orders, in order to create them, you need to go to the corresponding menu or press the Insert button on the keyboard.

Significantly more new parameters, right? Do not oversimplify, however, as amateurs: "Forex is simpler than the stock market, and options are simpler than Forex" - everywhere there are peculiarities, pros and cons.

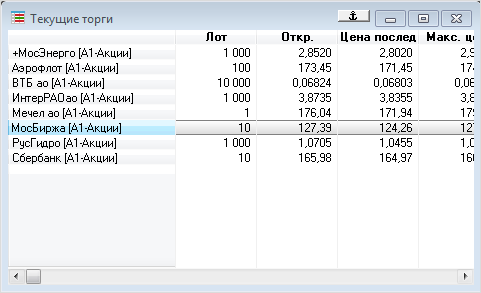

The Quik terminal seemed to me somehow more accessible: the interface is intuitive. By the way, many users who switched from the foreign exchange market to the stock market (as evidenced by the reviews) are in solidarity with me here. The work area looks like this (of course, you are allowed to open other windows).

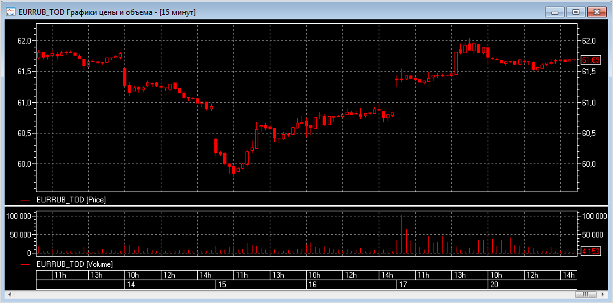

In the screenshot above, I marked the "bars" under the price charts with yellow rectangles. This is done so that you pay attention to the volume indicators, which we will talk about in the articles on "Indicator Analysis on Forex".

On the stock exchange, the volumes are not tick, but monetary, they show the real amount of money invested by clients, therefore they are considered quite authoritative indicators.

Take a look at the lots traders are trading.

Doesn't compare with some 0.01 - 0.02, which we operated on, right? I would like to emphasize once again that the stock market operates according to completely different laws. If you learn to see not only the key theoretical differences between certain segments, but also to feel their deep features, you will move a big step forward in trading (after all, the financial market, in theory, is the only one, these are people, for convenience, divide it into its component parts) ...

When trading through Quik on a single account, we come across currency pairs that have not previously appeared in any review published by us, because the standard currency accounts of brokers, for the most part, do not allow trading them. Example - the EUR / RUB chart (Euro / Russian ruble).

To open a real account, in addition to the information provided, you will need scans of passports, TIN. Any "normal" broker pays 13 percent tax on client profits at the end of the year or when applying for a withdrawal of the earned funds. If the trade turns out to be unprofitable, you won't have to pay any taxes.

To open a real account, you need capital in the amount of 30,000 rubles. Please note that this applies only to a single type of account. Everything is much easier with Forex.

Account for currency trading with Finam

So, let's return to the path closer to us. Go to the Forex heading and find that trading operations are performed through the already familiar MetaTrader, you can work with 26 currency pairs - enough for both beginners and professionals.

Here we similarly need to create a demo account and download MetaTrader. The amount of funds on the demo account is 5,000 dollars.

A list of all currency pairs that can be traded is presented in the screenshot below.

At first I thought that there are much more of them than in Alpari, but the euphoria quickly passed: the minor instruments are not separated from the major ones, and this is a deceptive appearance. So Alpari is absolutely not inferior to Finam in terms of the number of assets.

The procedure for opening a new order is distinguished by the impossibility of setting an indent. That is, the deal will be opened at the price that will be in the market when you click the "Sell" or "Buy" button. The system eloquently warns that the deviation may be significant, but does not try to protect against it.

Here, the minimum threshold is only one hundred dollars, so you can start successful trading without much stress, create a real account, deposit money and start earning.

Shares for Finam traders

Finam offers its clients various promotions to get a higher income (all information is presented in the personal account for registered traders, for unregistered ones - just on the website). I personally am not a supporter of any "bonuses" or "gifts", because free cheese is always only in a mousetrap. However, as part of the review, I consider it necessary to talk about them.

You can receive a Broker + card through a bank branch and transfer money from it to your trading account. Credit is provided on the card, maximum amount which is equal to 6,000,000 rubles. This money is needed to be injected into the auction. Loan term - 11 months and 20 days.

On the one hand, it's good, there are more opportunities, on the other hand, it seems to me, you should never trade with borrowed funds. Never. This is the market, he likes to surprise at times.

On borrowed funds, of course, interest is charged - exactly 15 per year. This is not so little, if you operate with large amounts.

If you carry out financial transactions on a single account, you can insure the purchased shares against a decrease in their value. This is not done for free, but if the stocks suddenly really fall sharply (and they are capable of such things, which cannot be said about most currency pairs), Finam will pay you most of the lost money.

The cost of insurance is 4-9 percent of the price of the entire block of shares. If, for example, we have 100,000 Lukoil shares and their market price is 3,000 rubles, we can insure the package for three months (the terms vary in the same way) by paying Finam 6 percent of the total value of all shares. The amount of insurance will be 3,000 * 100,000 * 0.06 \u003d 18,000,000 rubles (I exaggerate, of course, although there are large players working with such amounts).

If suddenly the price drops by 400 rubles, the possible losses will amount to 40,000,000 rubles, with insurance we will lose half as much.

Intraday traders do not need insurance as they open and close within one day and do not have to worry about gaps. Proponents of long-term and medium-term trades use insurance regularly.

How do you plan to dispose of the money that you earn on the exchange (if you earn)? Put it in the bank? Excellent, Finam also provides such an opportunity, the amount of interest per year depends on the time the funds are in the bank. For an account of the "Maximum" type ( minimum amount deposit in rubles - 10,000) the conditions are as follows.

| Term (days) | 31 — 60 | 61 — 90 | 91 — 180 | 181 — 364 | 365 — 731 |

| Rate (%) | 5 | 5,75 | 7,5 | 8,5 | 8,5 |

If you deposit money into a "Best" type account (the minimum amount in rubles is 300,000, in dollars or euros - 3,000), the conditions are a little more promising.

Naturally, it is necessary to motivate people to invest in rubles, since the dollar in the long term maintains an upward trend, the rubles can be increased much more efficiently than the American currency.

Trading training with a broker Finam

We examined the main promotions and opportunities to increase capital (the rest periodically appear and disappear, so you need to track the situation directly through your personal account), now let's talk about training.

I was immediately struck by the prospect of observing the real transactions of professional traders through the "Trading Hall". At certain times of the day, you can connect to online broadcasts, watch the trade of professional introday speculators and scalpers. It is allowed to ask questions to the presenters or other "observers", to discuss the reasons for opening / closing deals.

Naturally, the "Trading Room" cannot be perceived as step by step guide to action: all deals will definitely not be profitable, but you can improve your trading skill by watching the broadcasts very well.

Paid lessons prevail among training webinars and seminars. There are, of course, completely free basic lessons for beginners, where they become familiar with the trading platform, the essence of Forex, and the basics of those. analysis, but you have to pay for more serious things.

When we are, we will notice that things are much better there: a huge number of free webinars, and there are no paid ones as such: access to viewing some courses can be obtained after replenishing a trading account for a certain amount, money is subsequently withdrawn without problems, the maximum loss - commissions charged by payment systems.

From time to time, Finam hosts free video seminars on various aspects of trading. They will be of interest to those who are already relatively confident in the market, have successfully mastered the basic course and are able to "highlight", form their own trading strategy. Examples of seminar topics.

In my opinion, an interesting section is the "Trader's Library", where many useful information in text format. Unfortunately, the material is not yet available in all sections, on Forex it is generally quite poor, but a lot of interesting things are available on the stock market.

Conclusion

So, dear friends, we have completed a brief introduction to the main features of the Finam broker, talked about trading platforms, financial instruments, educational programs.

The broker has been successfully operating since 1994, it has stood the test of time with dignity, and the reviews on its network are quite passable. There is no need to worry that the company will somehow steal your money or paint on the “wrong” quotes on the charts.

You can directly register in Finam and start mastering the market, you can read articles about other brokers (see 11 the best companies in the article), in particular, the material of a pro - company that gives huge deposits to successful traders on favorable terms (this is a rare example of not cheese in a mousetrap).

If you have any questions, feel free to ask them in the comments. Thank you, successful trading, maximum profitable trades.

Organization FINAM, which is an investment company with an investment holding of the same name formed on its own base, was established in 1994. This company was one of the first in the Russian state to begin providing services related to activities in the stock markets.

Today FINAMprovides one of the most extensive types of investment services for legal and individuals... This is a service that starts from providing an opportunity to invest resources within Russian as well as foreign exchanges, trust distribution of assets, and ends with comprehensive support of transactions for the purchase and sale of a business.

The holding is active in the field of investment, while investing resources in the purchase of land intended for agriculture and projects that are distinguished by the presence of high technologies.

Investment holding FINAM contains the following divisions:

JSC "Investment company called" FINAM "

It is considered the leader in the Russian brokerage service market, occupying the leading positions in the list of Russian brokers. Positions are determined by the turnover performed, the number of active and registered clients on the Moscow Exchange. Representatives of this company operate in more than 80 Russian cities. JSC " FINAM"Is a trading member of the Moscow Exchange, the Saint Petersburg Stock Exchange, a member of the National Association of Securities Market Participants.

The company is engaged in the provision of brokerage services on a large scale. It is designed for clients with all kinds of financial capabilities. FINAM also provides direct access to trading platforms in Russia and presents to investors products with full financial protection, individual advice to managers that increase the efficiency of investments.

When concluding an agreement with JSC FINAM, the client is promised very favorable tariff plans and access to high-tech applications.

Also, JSC FINAM offers its clients daily analytical research, investment plans, analysis of various companies and proposals related to the formation of investment portfolios.

FINAM JSC was named a multiple winner of awards in the Finance Department. 2014 was marked by a significant event for the company - it was awarded the “Financial Elite of Russia” prize. Previously, the company has repeatedly won this award in all sorts of nominations. In addition to all this, FINAM has repeatedly won the Financial Olympus awards and other prestigious business awards.

Investment banking institution "FINAM"

The institution provides wide range of services to individuals and legal entities. It specializes in complex innovative products, while expanding its own regional network.

Investment banking institution FINAM is an influential high-tech company. The complex of the institution, which performs hardware and software functions, interacts with the MoneyMail payment system. Such activity is a guarantee of the safety of transfers and the safety of financial resources.

Through newly invented payment technologies and interactions with other banks, the institution is able to provide simplicity and huge opportunities such a service. The account can be replenished through various methods operating within the Russian state. The MoneyMail virtual store presents a complete toolkit that helps to significantly increase sales and organize a variety of marketing campaigns.

LLC "Managing firm" Finam Management "

It has been part of FINAM since 2002 and manages the assets of corporate, institutional and individual investors. Today, the firm is considered one of the leading players in the area of \u200b\u200btrust management in Russia.

The company has at its disposal pension savings transferred by the RF Pension Fund, assets of investment mutual funds, stocks of target financial capital, resources of self-regulatory institutions.

Finam Management presents various versions of strategies that are relevant today for various categories of institutional clientele, because the firm's specialists have ten years of experience in the field of trust management of pension savings, SRO compensation reserves and also endowment funds. Carrying out a responsible and fruitful activity in 2013, the firm was among the 15 largest management firms in the rating reflecting the amount of endowment capital.

The management of pension savings of Russian citizens occupies a significant place in all activities of Finam Management. The method of working with these funds is based on an investment strategy and multilevel risk assessment.

Service "Trust Leadership-Light" covers a large number of investors. It offers a wide range of active investment strategies and an individual approach. Investors with large capital can count on the service from Premium. The client has the opportunity to use individual strategies that are developed based on the preferences of a particular investor, established terms of cooperation, acceptable risk levels, etc.

For investors with qualifications who like to use portfolio diversification, the firm offers the service “ Trust management in international markets ". It can be used to invest in shares of global companies and in foreign exchange traded funds, which are convenient and relevant financial instruments abroad. The firm has also developed investment strategies for the BRIC Countries, the Flagship of Europe, and the New Asian Tigers.

Finam Management has the following licenses: to carry out activities in the management of investment funds, mutual funds, non-state pension funds No. 21-000-1-00095. In addition, the firm is licensed as a professional participant in the market of valuable documentation for the implementation of management activities No. 077-11748-001000.

This group, being an international brand "FINAM", refers to brokers who specialize in providing certain types of services. The service is aimed at a diverse audience. The group is considered a licensed European broker and provides interested clients with access to all global trading platforms.WhoTrades Inc.of American origin provides a service that provides direct access to US stock trading and is considered a member of stock exchanges and also off-exchange trading systems. And the service that gives access to the American derivatives market and the international foreign exchange market comes from another licensed broker.

WhoTrades.com is a global social network dedicated to traders. Here users are presented with a huge range of high-quality services on the leading exchanges in Russia and foreign countries.

The group's network of more than five hundred thousand people is very successful in realizing the all-in-one concept. As a result, both novice investors and experienced traders, in addition to using a brokerage service, have an unusual opportunity to improve their trading skills. This can happen in the course of activity on financial platforms, and also, in the process of interaction with other persons using the portal. With the help of a social network, you can follow the progress of transactions among the best traders, consult and share new ideas. In addition to communication, network participants have the opportunity to trade within the exchange, use the offered services of the group and learn the principles of trading in the markets.

The trading conditions of this group are among the most favorable conditions in its own segment. Clients can achieve low spreads on major currency pairs, no swaps and high leverage.

Chain FX Light service allows the client to connect to the trading process of the most experienced traders. Then the manager's income will be repeated automatically on the brokerage account.

Another service provided by this group organically complements the popular service "Exotic or Binary Options" today. It is an application that allows users to make money on forecasts of changes in the value of gold and currencies in a short time.

Insurance Consultant Finam Insurance

It is a consultant providing a huge range of services within the insurance market for individuals and legal entities.

ADVANTAGES OF THE INSURANCE CONSULTANT

Saves a lot of time.

There is a possibility to choose.

There is professional advice.

Money is saved.

Finam Insurance representatives have vast experience in insurance companies. They have extensive knowledge of the specifics of their functioning. By contacting here, the client will be able to acquire a complete professional assessment of tariffs, conditions, as well as insurance rules, taking into account the wishes of the client.

The company provides support and advice to clients in all available stages of the insurance agreement: if it is necessary to make changes or additions to the insurance agreement, if an insured event occurs and it needs to be settled, if it happens controversial situations with a company.

Finam Insurance will also assist in obtaining an insurance agreement with the widest coverage, for a minimum amount and at the request of the client.

Finam Insurance service is free of charge for clients.

Types of insurance

FOR PRIVATE PERSONS:

Compulsory auto insurance

Car insurance

Insurance of an apartment, a summer residence

Health insurance

Accident insurance

Liability insurance

Life insurance

FOR LARGE ORGANIZATIONS

Fleet insurance

Property insurance

Insurance of construction and installation activities

Cargo insurance

Voluntary medical insurance

Accident insurance

Liability insurance

FINAM LIMITED

It is a licensed European broker providing a comprehensive service for activities carried out in the international financial markets. Today FINAM LIMITED clients can carry out transactions on all major world exchanges. In addition, this broker cooperates with foreign investors who are interested in investing in Russian assets. FINAM LIMITED serves clients in Armenia. Armenbrok is a representative of the company in this country.

FINAM LIMITED is still developing new services. Basically, he oversees the creation of specially designed options for trading programs that meet the requirements of investors, prepares various analytical materials, and develops relations with foreign exchanges.

Start of activity: 1999

· Operating website: www.finam.ru

Country of registration: Cyprus

Regulated by: MiFID

· Payment methods: electronic and bank transfers, terminals, internal transfers.

Minimum deposit: $ 100

· Minimum size transactions: 0.01 of the standard lot

Spread: starting from 2 pips on EUR / USD

Credit leverage: up to 1: 200

Trading terminal: MetaTrader 4

· Trading instruments: 28 currency pairs, contracts for Russian stocks, world stock indices, oil, American stocks.

Finam Capital Partners

This is a mutual fund of Russia, which specializes in investments in high-tech projects. The beginning of its own activity - 2008.

Finam Capital Partners Is part of a joint stock company aimed at raising capital. The fund operates in the Finam Group, which is considered one of the leading providers of brokerage services in Russia.

Information Provision Agency Finam.ru

The agency is a leader and provides news in the field of finance. It also helps to develop the family of business portals.

"Training center" FINAM "

He is the leader in the field of stock education in Russia and every year trains tens of thousands of individual investors on the territory of the Russian state.

The center conducts training seminars, courses, lectures in Russian cities. Its instructors are experts with a wealth of successful experience in the financial markets. They are the authors of a large number of articles and books covering the field of investment.

The courses cover all available areas of investment, from trading on the currency market to working on Russian and international stock platforms. There are also various kinds of educational ideas for existing investors that are associated with collective investments, retirement savings, personal budget planning, etc.

The educational central institution "FINAM" has implemented a huge program of distance learning courses - they provide an opportunity to learn how to work in the financial markets at home. There is a live broadcast, where video seminars and courses on various topics are broadcast, which are stored in the archive. During training, the student independently chooses a mentor, topic and time of the lesson.

The center broadcasts three television channels. This is "Finam TV" - a large-scale resource containing programs that are dedicated to the Russian stock market, "FXTV" - a channel intended for traders - traders in the currency market. The third channel, Algorithm TV, is aimed at those who prefer automated trading systems. The teachers of the center are active participants in the improvement of the social network of traders WhoTrades.com. The webpage of the network contains webinars of renowned teachers, specialists conduct educational discussions, publish their own research on market situations.

Investor Diary: "Think and Grow Rich"

Capitalist

Greetings! We continue our review of popular Russian brokers. And today the FINAM broker will become the highlight of the program: reviews, pros / cons, services, tariffs and my personal opinion.

FINAM Holding was founded back in 1994. The company is a member of the American NASDAQ electronic exchange. FINAM offices are open not only in Russia, but also in the EU, the USA and the countries of Southeast Asia.

Some statistics taken from official site... In August 2015, FINAM's turnover in the international financial market exceeded $ 54.3 billion, and another $ 60.5 billion “rolled over” in the Russian financial market. At the same time, FINAM controls about 14% of trading on the MICEX and is among the top three!

At the moment, the structure of the holding looks like this:

- JSC "Investment company" FINAM "(brokerage services)

- LLC "Managing company" Finam Management "(). The company even manages pension savings, mutual fund assets and endowment funds.

- Finam.ru LLC (information and analytical agency)

- FINAM Bank CJSC (well, everything is clear here - this is a classic Moscow bank with standard set services)

- WhoTrades (brokers that specialize in specific services). For example, WhoTrades Inc. presents direct access to the US stock market

- FINAM GLOBAL Investment Fund (invests and takes part in the management of promising companies)

- ANO "Training Center" FINAM "(conducts training lectures, seminars and courses in large cities of Russia). By the way, the training center also has very decent distance programs.

The broker's clients trade on stock exchanges from 40 countries of the world, and FINAM representative offices have already been opened in 100 cities of Russia.

And of course, over the years of its work, FINAM has managed to receive a lot of prestigious awards. For example, last year the company was awarded the Financial Elite of Russia 2015 award in the Grand Prix: Investment Company of the Year nomination.

Finam broker situation today

FINAM now provides traders with access to the following trading platforms: RTS, MICEX, NYSE, NASDAQ, Toronto Stock Exchange, Deutsche Börse, London Stock Exchange, Bolsa Mex.

Trading is carried out using the terminals QUIK, MetaTrader 4, MetaTrader 5, Multi Exchange, FinamTrade, Transaq, HFT, Livetrade Professional, Volfix.

You can deposit money to a brokerage account in the following ways:

- Cash (through the cash desk of CJSC Finam, cash desk of Bank Finam or KKS Bank in the regions)

- By bank transfer (from a plastic card of Bank Finam or from a bank account of another bank)

- Via DeltaPay terminals, the Pay on the way payment network or the Mobile Element network of companies

For the sake of fairness, I want to note that many clients complain about the long terms for crediting funds to a brokerage account (sometimes it takes a day or two). In other words, FINAM regulations are often not followed. Especially, this applies to transferring money from a third-party bank account.

In addition, any bank (except for Bank Finam) will certainly withdraw its commission - as for a replenishment operation brokerage accountand for withdrawing money from it (0.5-3%). Therefore, it is much easier (and cheaper) for a trader to open an account or get a Finam Bank card.

By the way, the most quick way withdraw money from a Finam brokerage account - withdraw money in cash (through Finam cash desks) or to the details of a bank account in their own Finam bank. Withdrawal to other banks will make you wait 2-3 days. And then, only after submitting an order (this can be done online through " Personal Area»).

FINAM brokerage services

FINAM offers traders a huge selection brokerage services, services and products. I will not describe them in detail, but just list the most interesting ones.

FINAM provides access to the stock (12 tariff plans), urgent (4 tariff plans) and foreign exchange markets (8 tariff plans).

“Currency” FINAM is a trader's entry into foreign exchange trading on the Moscow Exchange and on the international foreign exchange market. A private trader can make transactions with currencies at real exchange prices on highly liquid platforms with minimal spreads.

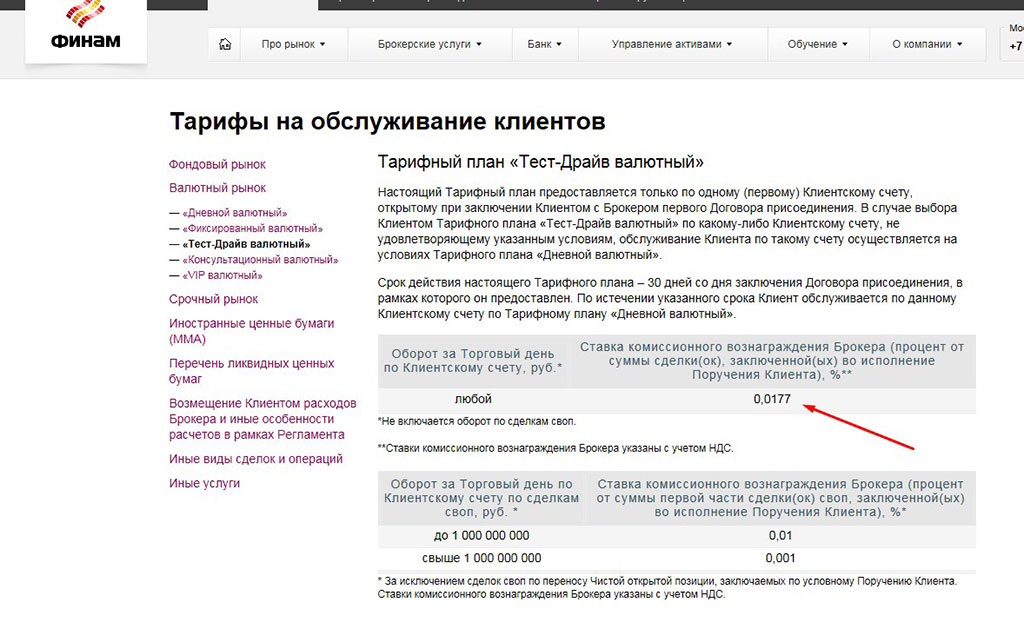

Beginners should definitely start with a tariff plan. "Test Drive" (Moscow Exchange): leverage 1: 9, minimum for opening - 30,000 rubles, broker commission - 0.0177% for any turnover.

I was also interested in the "Light" tariff - the leverage is 1: 500, the minimum opening amount is $ 5, the spread is from 0.5 and there is no commission to the broker. You can trade 50 currency pairs, as well as silver and gold.

"Stock" FINAM provides access to the most interesting stock exchanges around the world. There are at least 3 options to choose from.

For example, the "US Markets - Direct Access" tariff makes it possible to enter American stock exchanges directly. This will open an account in Cyprus with WhoTrades. The broker is licensed in NFA and CySec (Cyprus). But the minimum opening amount is $ 3000, the commission for each trade is $ 4.75, and the leverage fee starts from 5.5%.

A similar tariff plan called the "US Market" brings the trader to American sites no longer directly, but through JSC FINAM. In this case, the minimum opening amount drops to 10,000 rubles, and the broker's reward starts at $ 0.004 per share.

"Urgent" FINAM offers traders profitable terms for trading options and futures.

The most interesting variant of the tariff plan is called “MMA - a single merchant account”. There is no service fee, the minimum opening amount starts from $ 200, and you will have to pay only 45 kopecks for each contract.

By the way, if you plan to trade on the Moscow Exchange, they will try to impose on you the Transzak terminal in every possible way. One of my friends even had to threaten to close the account and only after that he was provided with Quick.

Other broker services

Capital protection

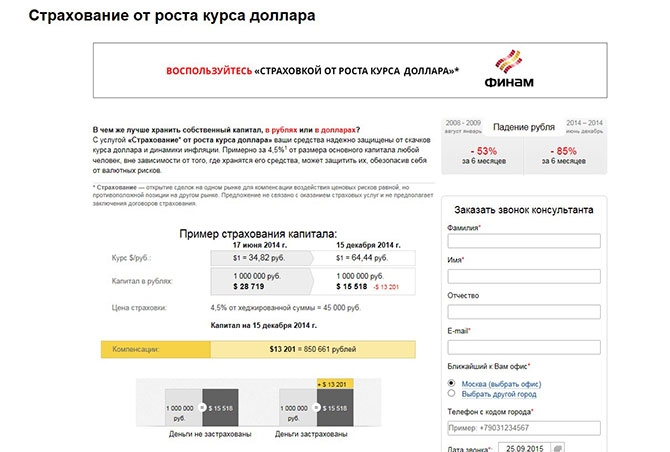

Unlike many other Russian brokers, FINAM offers its clients several insurance options. For example, “from the depreciation of the ruble” and “from the decline in stock prices”. For 4.5% of the amount insured, the holding fixes the current rate for you for a period of one year. Most likely, an option is simply bought for this amount in the derivatives market.

Professional support

In FINAM, an investor and a trader can order a consulting department. For example, in the US market or Hong Kong.

Information and analytics

In my opinion, FINAM compares favorably with its competitors with a decent level of analytical and information service. Clients are provided with intelligent market reviews, news from DowJones, calendar of events, trading signals from Autochartist, and forecasts from Trading Central.

Some of the analytics are open to investors and traders in the public domain, some are included in the price of tariff packages.

Pros and cons of a broker

Among the advantages of FINAM, most users consider the company's high level of reliability, stable operation of the QUIK terminal, the ability to enter foreign markets and a large selection of convenient services for traders.

Personally, I would definitely attribute high tariffs to the minuses. In addition, the regulations are not always observed, and the "Personal Account" of the trader is too "bureaucratic".

Personal opinion

Perhaps it is the broker FINAM that offers traders maximum amount products, services, services and training materials on the Russian market. Personally, I appreciate it, first of all, for its reliability and recommend it for cooperation (although the commissions are somewhat high, relatively).

Many people also like the Transzak terminal, which is own development companies. Plus, thanks to the same terminal, it is in Finam that it works most stably.

Well, if you are just planning to open an account to access the Russian stock market, I recommend that you visit this free webinar Dmitry Mikhnov.

By the way, I forgot to mention! It is on the Finam website that there is unique opportunity download the history of quotes, for example, for the derivatives market. You can use it in a strategy tester, for example, such as Multicharts, Forex tester or my favorite TSLab and launch your “copy of the market”.

Have you ever worked with FINAM? Did you like the terms of cooperation? Subscribe to blog updates and share posts on social networks!